Port of Long Beach fully behind push for ZEV trucks despite ACF failure: COO

The death of the Advanced Clean Fleets rule in California dealt a blow to zero-emission vehicles in drayage, but Long Beach remains committed. The post Port of Long Beach fully behind push for ZEV trucks despite ACF failure: COO appeared first on FreightWaves.

NEW YORK – With the impending formal death of California’s Advanced Clean Fleets (ACF) rule, it would be easy to assume efforts to position the state’s ports at the forefront of adopting a growing percentage of zero-emission vehicles are running into huge headwinds.

But monthly data from the Port of Long Beach continues to show that the number of ZEVs operating at the state’s largest port is rising. The growth goes on even without the ACF mandate that, had it been implemented, was going to have its biggest initial impact on purchases of new drayage trucks.

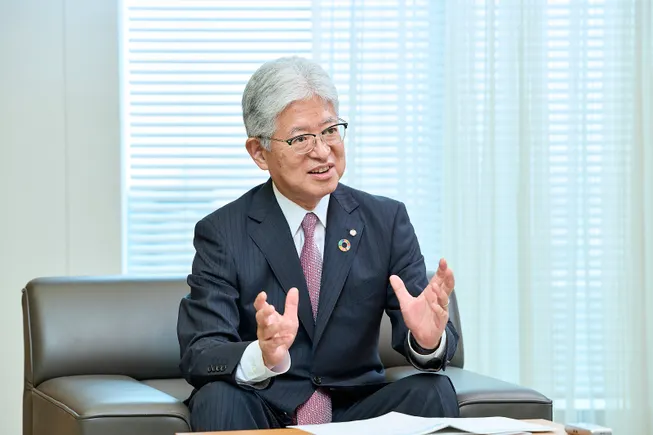

In an interview on the sidelines of a presentation by the Council of Supply Chain Management Professionals, Noel Hacegaba, the Port of Long Beach’s chief operating officer, expressed little concern that the demise of the ACF would mean the end of the port’s plan to transition to an all-ZEV fleet by 2035.

“We never expected this journey to be a smooth, seamless one,” Hacegabe, who has a doctorate in public administration, said in an interview with FreightWaves. “As all of us are learning on different fronts, things can change on a dime, but we’re not going to deviate from our goals, and we’re not going to deviate from our plans.”

The shift to ZEV drayage vehicles was long planned as one of the first concrete steps the state would take when the ACF was to be implemented at the start of 2024. Under the rule, any new vehicles entered into the state’s drayage registry would need to be ZEVs. There was no leeway for a low-emission vehicle, like a natural gas-powered truck. The drayage truck would need to be propelled by batteries or hydrogen to be considered a ZEV. If it wasn’t, it couldn’t be registered.

But when California decided in late 2023 not to begin enforcing the ACF because of the legal battle over whether the state needed a waiver from the Environmental Protection Agency to implement the rule, that registry mandate was put on hold. With the state withdrawing its request for a waiver during the waning days of the Biden administration, the drayage rule suddenly had no future.

That did not stop some drayage operators from adding ZEVs to their fleet. The Port of Long Beach publishes monthly data on the number of ZEVs operating there and recently also has reported how many are battery-electric vehicles and how many operate on hydrogen. As the graph in the below post on X shows, that growth has not stopped: Total ZEVs have been up every month since the start of 2024. What cannot be known is how high the number would be had the mandate gone into effect.

In the interview, Hacegaba noted that the port has been collecting a $10 fee per twenty-foot equivalent unit since April 2022 to create a pool of money that would help the transition to more ZEV drayage vehicles. That fund is still in place, even if the ACF is not.

“Right from the very beginning, it was always intended to help incentivize the industry transition to zero-emission trucks,” Hacegaba said. “In light of some of the developments on the policy front, our intent is to look for ways to accelerate the transition.”

Growth in charging infrastructure

An early push, according to Hacegaba, was to install more charging facilities at the port. He said as a result of that initiative, there are now 100 charging stations within the port. The plan is to increase that to 300 within 18 months. As a result, he said, the supply of charging stations is now adequate.

“Now we’re going to pivot once again and look for ways to help incentivize the transition of cleaner trucks through incentives,” Hacegaba said in discussing how the clean truck assessment money will be used next.

The ACF was always meant to work hand in hand with the Advanced Clean Trucks rule, which did receive a waiver from the Biden administration EPA. (That waiver is now threatened by congressional action.)

ACF was to mandate that fleets buy ZEVs, not just for drayage but for other trucking uses. And with that mandate in place, ACT was to lay out how OEMs would need to supply California with ZEVs to meet the demand coming out of the ACF.

Will the trucks be available?

With the ACF now dead in all but name, the question since January has been whether OEMs will build the ZEVs the state continues to seek in the absence of the ACF.

Hacegaba was cautiously optimistic about OEMs delivering enough ZEVs to meet the goals of the California ports to free themselves from internal combustion engines.

He noted that there are still subsidies and incentives funded by the state, and that its programs could be expanded. “There is an opportunity for ports like ours and the state to step in and see how we could potentially close the gap and make these trucks more affordable,” he said.

And if that happens, he added, “that will give comfort to these manufacturers that there is still market interest. That will go a long way.”

Hacegaba also suggested that the ongoing bankruptcy of hydrogen truck manufacturer Nikola could present an opportunity for the state to step in and acquire assets from the company. “We’re looking at ways to help incentivize the utilization of these hydrogen assets,” he said.

Although the number of ZEV trucks is rising, other data in the port’s monthly report shows how tough it will be to get to a full ZEV fleet, especially without a mandate.

In the latest report for April, even with the number of ZEVs up 92.5% from April 2024, the percentage of all moves within the port carried out by a ZEV rose only to 1.78%. It was 1.25% a year ago.

And while natural gas-powered drayage trucks are not seen as having a long-term future in an all-ZEV port, some advocates believe they do have a role in cleaning up emissions.

But natural gas vehicles in April accounted for 4% of all port moves. A year earlier, in April 2024, it was 7%.

More articles by John Kingston

Last-ditch attempt at tort reform in Texas falls short as second bill fails

Georgia tort reform aims to change practices in judicial ‘hell hole’

BMO’s Q2 earnings show no improvement in credit conditions for trucking

The post Port of Long Beach fully behind push for ZEV trucks despite ACF failure: COO appeared first on FreightWaves.