One-day stock slide at Proficient may be tied to somewhat bearish investor presentation

Proficient Auto Logistics saw its stock plummet for a while on Wednesday, possibly due to an investor presentation. The post One-day stock slide at Proficient may be tied to somewhat bearish investor presentation appeared first on FreightWaves.

Proficient Auto Logistics’ stock price fell hard Wednesday before a late rebound, possibly in reaction to an investor presentation that had some bearish overtones even if it offered no significant observations that management had not made previously.

Proficient (NASDAQ: PAL), the auto carrier that went public a little more than a year ago after rolling up five separate carriers, at one point Wednesday fell to a 52-week low at $6.61. The stock had closed Tuesday at $8, so Wednesday’s low was down about 17.4% on the day.

It rebounded later to close at $7.57, a decline of 43 cents per share, or 5.37%. The closing price brought PAL stock back into a fairly tight range of recent closing prices ranging from $7.25 on May 23 to $8.06 on May 30.

Proficient’s stock is down more than 50% in the past 52 weeks, according to data in Barchart. The closing price Wednesday was down almost 64% since its 52-week high of $21.01 on July 31.

In a brief interview with FreightWaves, CEO Rick O’Dell said there were no statements in either the slides or in the in-person presentation at the William Blair investor conference in Chicago that Proficient believed would have been consistent with a sharp drop in the stock price. “We weren’t saying anything, frankly, that we hadn’t already spelled out pretty clearly in the last earnings call,” O’Dell said. “Our messaging was consistent with the last earnings call in May.”

The presentation was not broadcast, and there is no transcript of what Proficient officials said.

However, the company did release the slides it used at the presentation. While there was nothing significantly new in the outlook Proficient faces for demand for auto hauling services, it does appear that some of what was in the presentation – or possibly in the unreleased comments by Proficient management – may have set off the drop in the stock price.

Among the bullet points in the presentation, Proficient made several projections about the market for car sales that provides it with its base of business.

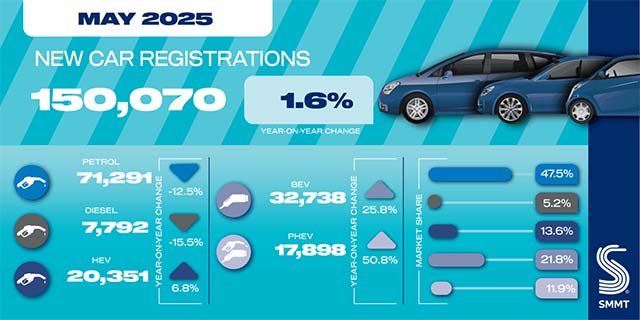

- The seasonally adjusted annual rate of sales in May was expected to be less than in March and April, when “pull-forward” sales made for a relatively strong March and April. Forecasts for the full year are “generally lower with a greater range of uncertainty.” A graphic said the SAAR for March was 17.8 million vehicles; for April it was 17.3 million. The May forecast was 16 million vehicles on a SAAR basis, the same as in February.

- Inventories of new vehicles are “down substantially.” Some importers have stopped bringing in new vehicles.

- The possibility of policy changes including additional tariffs has “obscured and stalled OEM plans.”

The end result, according to the Proficient slides, is that “as pre-tariff dealer inventory is sold and prices increase with tariffs, sales momentum is expected to slow further.”

The OEMs that are the core of Proficient’s business “are tending toward incumbents on contract bids,” the presentation said. But for carriers, the company added, “near-term pricing power is weak.”

Talking about Jack Cooper

The presentation contained a chart showing a rough estimate of PAL’s market share. It did not list the number of trucks at its competitors but put its own fleet at 1,200, third-largest in the U.S.

United Road was listed as the largest carrier. Jack Cooper was second, with the chart noting that it had closed its doors earlier this year. Also in the top five were Hansen & Adkins as the fourth-largest carrier and Cassens Transport fifth.

Jack Cooper was organized by the Teamsters. When Proficient was launched, it stressed repeatedly that it was nonunion. In the nine companies listed as the top haulers, the only one besides the defunct Jack Cooper that is listed as union is Cassens Transport.

While Proficient executives did not say much on the first-quarter earnings call about the demise of Jack Cooper, the presentation to the conference had more information.

It said that after OEM contract business at Jack Cooper was redistributed through the market, “much of the truck capacity left the market and will not return.”

But rather than providing a boon for carriers, the Proficient presentation said “the effect has been muted by weaker overall market conditions.”

And taking another dig at unionized companies, as it did often when Jack Cooper was operating, the Proficient presentation said “non-union opportunities offer greater earnings potential for motivated drivers.”

Proficient had a first-quarter operating loss of $2.36 million, a slight improvement from $2.4 million in the fourth quarter.

The Proficient slide said the company is “projecting sequential growth in total revenue in the high single digits for the quarter” and also expects “improved profitability.”

More company hauling forecast

Another point made in the presentation is that Proficient now has 65% of its revenue from third party haulers or owner-operators, with company trucks making up the balance. But the company also said the goal would be to convert more of that share to company trucks, given the higher operating margins compared to purchased transportation.

More articles by John Kingston

Last-ditch attempt at tort reform in Texas falls short as second bill fails

Port of Long Beach fully behind push for ZEV trucks despite ACF failure: COO

BMO’s Q2 earnings show no improvement in credit conditions for trucking

The post One-day stock slide at Proficient may be tied to somewhat bearish investor presentation appeared first on FreightWaves.