How Jim Rowan made Volvo a software company that builds cars

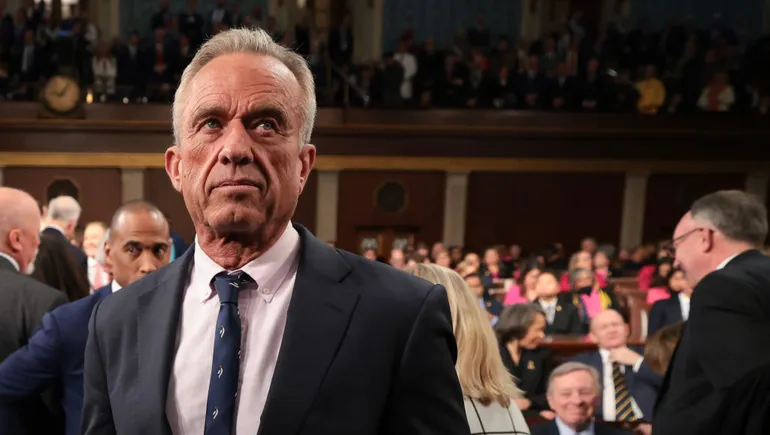

Rowan has stepped down as CEO; in his final major interview he explains the "Darwinian event" facing car makers Volvo boss Jim Rowan has stepped down from the firm with immediate effect, following three years at the helm of the Swedish car firm. During his time with Volvo, the former Dyson executive oversaw the launch of the EX30, EX90 and ES90, and has been a key proponent in the company's push towards software-defined vehicles. He will be replaced by his predecessor, Håkan Samuelsson, who previously led Volvo from 2012 until 2022. In this interview with Autocar – his final before exiting the firm – he says car makers face a "Darwinian event", and lays out his plan for Volvo to come out on top. “It’s not win-win. Somebody’s gonna lose” “If you’re looking for mental stimulation and sleepless nights, then come and join the industry,” says Volvo Cars CEO Jim Rowan, who did just that three years ago this month when he moved to the automotive world from the tech sector. Compared with other car company CEOs, he speaks in a way that makes him still seem like an outsider – or perhaps an outlier – because the way Volvo talks so openly and extensively about software stacks, computer chips and processing power remains unique among legacy car manufacturers. Yet Rowan believes this is where the game is now at for the automotive industry and he cannot comprehend how far behind rivals seem to be in the way they present themselves and talk about electric cars as if they’re a new thing, especially when their companies’ very survival is at stake. “I’m not an automotive guy. I come from the tech sector and I’m absolutely flabbergasted by the amount of people that still talk about electrification, as if that’s the big thing,” he says. “We know about batteries. We know about embedding the modules. We know about even silicon carbide, which was a big story all of a sudden, but that’s not a new technology. We know about power electronics and so on.” Instead, says Rowan, the four key things for the automotive industry now are “software, silicon, connectivity and data” – and Volvo is advanced in its development of all of them. But far from this being an attempt by Volvo to reposition itself as a tech company, this tech push is at its core about doubling down on safety and ensuring its cars continue to get ever safer and more lives are saved. “When I say software, I mean full-stack software,” he says. “You need to be able to write from layer one of the silicon all the way up to the application layer of the car in order to control it properly. There are three companies in the world that have managed to do that: Tesla, Rivian and Volvo. There’s a lot of good car companies but none of them have figured it out. It’s a big deal – and freaking hard to get this done. But we’ve stuck at it.” This ‘Superset’ tech stack is on the Volvo EX90 and ES90 and it will be adopted by all future Volvos. Moving all of the car’s major hardware and software control functions onto a central system rather than individual ECUs (the archetypal software-defined vehicles we’re increasingly hearing more about) enables more meaningful, consistent and stable over-the-air updates, particularly in the context of active safety technology and how vehicle data from accidents or near misses can be used to help cars avoid these situations in the future. To handle the data, Volvo has been developing its own cloud architecture, which “most people are not”, says Rowan. This approach allows Volvo to retain control of all its data and make its cars safer remotely. “That’s the big story,” says Rowan, and it’s in contrast to buying an off-the-shelf cloud, “when you get nothing”. Volvo now has the second-biggest data centre in Sweden. He says: “We run our algorithms inside the cloud architecture and then we push that back into the vehicle so that it makes the vehicle better and stronger and strengthens the algorithms.” So why is Volvo pushing the tech story so hard? Do customers respond, or need to know? Rowan says part of it is to drive the value of the company due to this level of advanced, proprietary technology and control of Volvo’s own destiny, but he notes “the stock is not showing that valuation” yet. For customers, Volvo having remote control “of every node in the car” will enable more features to be added to the car. “People are still figuring out all the different use cases that we can get from that,” says Rowan, but he gives the examples of a dashcam being created out of the sensors and cameras, or an app that lets you check your car and where it’s parked remotely, as code that could be “written in an afternoon”. “But the biggest thing is going to be around the safety aspects,” he says. “Because we get all that data, we’ll be able to look at the algorithms of all crashes. We’ll really see the crash. We’ll get the tape recording from the car that happened in Wiltshire on a wet Sunday afternoon and see what exactly happened. We’ll interrogate that and say: if we ha

Rowan has stepped down as CEO; in his final major interview he explains the "Darwinian event" facing car makers

Rowan has stepped down as CEO; in his final major interview he explains the "Darwinian event" facing car makers

Volvo boss Jim Rowan has stepped down from the firm with immediate effect, following three years at the helm of the Swedish car firm.

During his time with Volvo, the former Dyson executive oversaw the launch of the EX30, EX90 and ES90, and has been a key proponent in the company's push towards software-defined vehicles.

He will be replaced by his predecessor, Håkan Samuelsson, who previously led Volvo from 2012 until 2022.

In this interview with Autocar – his final before exiting the firm – he says car makers face a "Darwinian event", and lays out his plan for Volvo to come out on top.

“It’s not win-win. Somebody’s gonna lose”

“If you’re looking for mental stimulation and sleepless nights, then come and join the industry,” says Volvo Cars CEO Jim Rowan, who did just that three years ago this month when he moved to the automotive world from the tech sector.

Compared with other car company CEOs, he speaks in a way that makes him still seem like an outsider – or perhaps an outlier – because the way Volvo talks so openly and extensively about software stacks, computer chips and processing power remains unique among legacy car manufacturers.

Yet Rowan believes this is where the game is now at for the automotive industry and he cannot comprehend how far behind rivals seem to be in the way they present themselves and talk about electric cars as if they’re a new thing, especially when their companies’ very survival is at stake.

“I’m not an automotive guy. I come from the tech sector and I’m absolutely flabbergasted by the amount of people that still talk about electrification, as if that’s the big thing,” he says. “We know about batteries. We know about embedding the modules. We know about even silicon carbide, which was a big story all of a sudden, but that’s not a new technology. We know about power electronics and so on.”

Instead, says Rowan, the four key things for the automotive industry now are “software, silicon, connectivity and data” – and Volvo is advanced in its development of all of them. But far from this being an attempt by Volvo to reposition itself as a tech company, this tech push is at its core about doubling down on safety and ensuring its cars continue to get ever safer and more lives are saved.

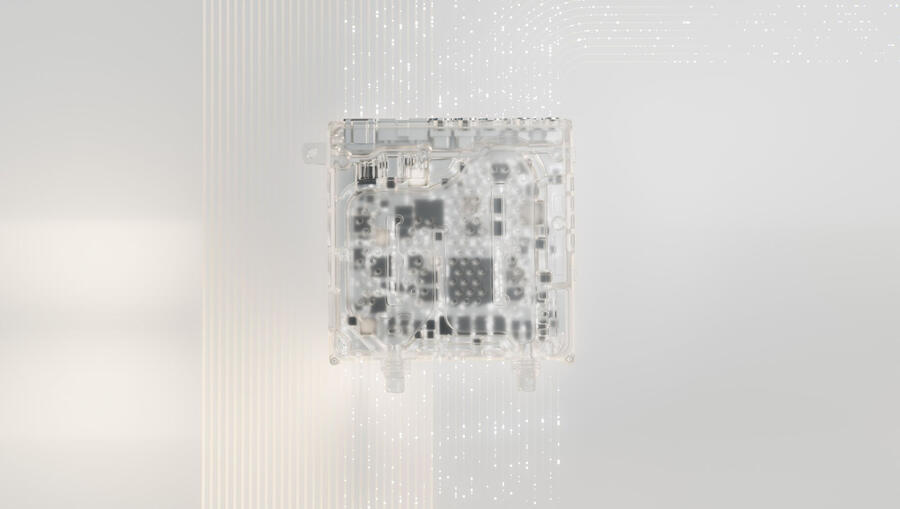

“When I say software, I mean full-stack software,” he says. “You need to be able to write from layer one of the silicon all the way up to the application layer of the car in order to control it properly. There are three companies in the world that have managed to do that: Tesla, Rivian and Volvo. There’s a lot of good car companies but none of them have figured it out. It’s a big deal – and freaking hard to get this done. But we’ve stuck at it.”

This ‘Superset’ tech stack is on the Volvo EX90 and ES90 and it will be adopted by all future Volvos. Moving all of the car’s major hardware and software control functions onto a central system rather than individual ECUs (the archetypal software-defined vehicles we’re increasingly hearing more about) enables more meaningful, consistent and stable over-the-air updates, particularly in the context of active safety technology and how vehicle data from accidents or near misses can be used to help cars avoid these situations in the future.

To handle the data, Volvo has been developing its own cloud architecture, which “most people are not”, says Rowan. This approach allows Volvo to retain control of all its data and make its cars safer remotely. “That’s the big story,” says Rowan, and it’s in contrast to buying an off-the-shelf cloud, “when you get nothing”. Volvo now has the second-biggest data centre in Sweden.

He says: “We run our algorithms inside the cloud architecture and then we push that back into the vehicle so that it makes the vehicle better and stronger and strengthens the algorithms.”

So why is Volvo pushing the tech story so hard? Do customers respond, or need to know?

Rowan says part of it is to drive the value of the company due to this level of advanced, proprietary technology and control of Volvo’s own destiny, but he notes “the stock is not showing that valuation” yet.

For customers, Volvo having remote control “of every node in the car” will enable more features to be added to the car. “People are still figuring out all the different use cases that we can get from that,” says Rowan, but he gives the examples of a dashcam being created out of the sensors and cameras, or an app that lets you check your car and where it’s parked remotely, as code that could be “written in an afternoon”.

“But the biggest thing is going to be around the safety aspects,” he says. “Because we get all that data, we’ll be able to look at the algorithms of all crashes. We’ll really see the crash. We’ll get the tape recording from the car that happened in Wiltshire on a wet Sunday afternoon and see what exactly happened. We’ll interrogate that and say: if we had deployed the airbag in a condition where the light is low and it’s a little bit slippery or whatever three nanoseconds earlier, that saves lives. That becomes meaningful to us as a safety brand. We need to be able to bring all of that alive to customers.”

Originally a mechanical engineering apprentice at Tate & Lyle in his native Scotland, Rowan soon switched into tech and held chief operating officer roles at both BlackBerry and Dyson and was CEO of Dyson from 2017 to 2020.

He succeeded the retiring Håkan Samuelsson, who in his decade in charge successfully lifted Volvo out of the mainstream and into the premium arena, where it could compete with the likes of Audi and Mercedes-Benz. That positioning is unchanged, and Rowan says that while he will continue to burnish Volvo’s traditional mechanical credentials, the job is now one of pushing Volvo’s tech prowess.

“That’s where the industry is going,” he says. “Quite frankly, if you don’t understand that and are not investing in that technology right now, you’re going to be left behind. The Chinese understand this really well.

“That’s why I’m flabbergasted sometimes by a lot of our competitors who still want to push for internal combustion engines. That’s great. They make a lot of money out of it, but they’re missing the point.

“I come from the smartphone industry. I was a BlackBerry guy. There were Nokia guys, Ericsson guys. There were Siemens guys. Philips used to build phones, Alcatel. None of them exist any more because we all thought it was about the RF circuit: how good is your connection?

“It was actually about software. It was about building an ecosystem that made the phone much more than a phone – and they missed it. The two guys who figured that out, Apple and Google, are trillion-dollar companies and the rest of them don’t exist.”

Investing in software is not at the expense of hardware, insists Rowan. “If we can enable that more with software and augment that, we can give a better experience. Look at Apple: I love the hardware. I love the brightness of the screen.

I love the way [an iPhone] works, the way it feels, how they build it. I love the software but, more importantly, I love the whole way the thing comes together. If we can emulate that within the vehicle itself, I think that’s the winning combination.”

Rowan says that the strength of brands means something quite different in the premium market compared with the mainstream, where the decision will nearly always come down to price. Yet “the premiumness of cars in the electric age is still being defined” and old brand values for premium car makers won’t necessarily carry over from the combustion era.

![]()

“With internal combustion engines, ‘premium’ is derived by [the likes of] ride quality,” he says. “If that was your brand attribute, you spent a ton of money because you put a big, heavy engine in the front of the car. You want to throw that car through the corners at 120kph [75mph]. You’d spend a lot of money on making a really smooth engine, on a really nice chassis, on suspension.

“Then, bang, all of a sudden there’s a new technology. You take a flat skateboard design and you get a nice low centre of gravity. Now you don’t have to offset this big, heavy engine in the front of the car, so suspension and, to some extent, chassis design becomes far less important. With battery technology, it’s not about the explosiveness and the smoothness of your engine, because you get torque for free. So now, what’s your brand attribute?

“What we’re seeing in China is people are saying: ‘Why would I buy this car when I can get the same acceleration, the same ride and handling for half the price?’”

Rowan says that Volvo’s brand attributes of safety and Scandinavian design won’t change in the electric era, but being a leader in technology allows customers “to come to us for different reasons”.

“That’s one of the big, profound changes that’s happening in the industry,” he says. “If we can augment that [traditional positioning] with better software, then the younger demographic will come to your brand and see a pretty cool car.

“We used to sell cars to accountants, doctors, dentists and lawyers. Now we’re selling a lot of cars to young software engineers, young marketeers, because the brand attributes are reasonably understated, reasonably humble, and especially when they have children, then they care about safety more than anything else.”

A question about the future of estates (according to Rowan, SUVs have taken their place essentially and Volvo cannot and will not enter every market niche as a relatively small company. A range of around eight cars will be enough) prompts a wider response from Rowan about how the industry is in a “Darwinian event” around survival, and who can successfully transition into software-defined vehicles.

“The guys figure this out quicker are going to come out strong, the guys who stick to the knitting,” he says. “There will be people who don’t come out of this and there will be fatalities. The guys with 10-15 brands, that’s going to be super-tough. They’re going to need to pare that back quickly.”

Rowan expects a significant change in around 18 months as brands start to disappear, from legacy car makers and from Chinese upstarts.

“They’re just not all gonna survive,” he says. “There’s not enough business for everybody. A lot of them are not making money already. They’re selling cars at a loss just to keep cash coming in. Eventually, that plays itself out and you’re going to see a thinning out of the multi-brand car companies that are going to need to say: ‘I can’t keep all these brands alive, so I’m going to need to shrink.’

“I don’t think you’re going to see car companies buying car companies. There’s just not enough business for everybody. So those guys will die out. The ones that are left will be much stronger because there’s less competition, and we’re going to be forced to be pretty lean to get through this.

“Everybody’s cutting costs. I don’t think it’s a bad thing for the industry. It’s super-interesting. It’s super-competitive right now. It’s freaking hard. But at the end of the day, if you want to win in the long term, you need to go through this. The only way to take market share in a flat market is to take it from your competitor. So unfortunately, we’re not in a win-win situation. Somebody’s gonna lose.

.jpg)