FedEx says economic uncertainty slowing parcel and freight demand

FedEx reported higher revenue and operating income in the third quarter than last year but says shipping business could slow this quarter because of weakness and uncertainty in manufacturing. The post FedEx says economic uncertainty slowing parcel and freight demand appeared first on FreightWaves.

FedEx Corp. shares fell more than 5% in aftermarket trading Thursday after the integrated parcel giant reduced its full-year guidance for the third consecutive quarter because of intensifying macroeconomic headwinds and uncertainty in the U.S. industrial economy, which are crimping higher margin B2B shipping services.

FedEx (NYSE: FDX) said it expects revenue to be flat to slightly down year over year from the previous outlook of flat revenue. The estimated range of earnings per share, excluding certain costs, is $18 to $18.60 compared to the prior forecast of $19 to $20 per share.

A primary area of uncertainty that could impact FedEx’s bottom line is the rapid escalation of tariffs and tariff threats from the United States, which is inviting retaliation and worries of diminished consumer demand because of higher prices.

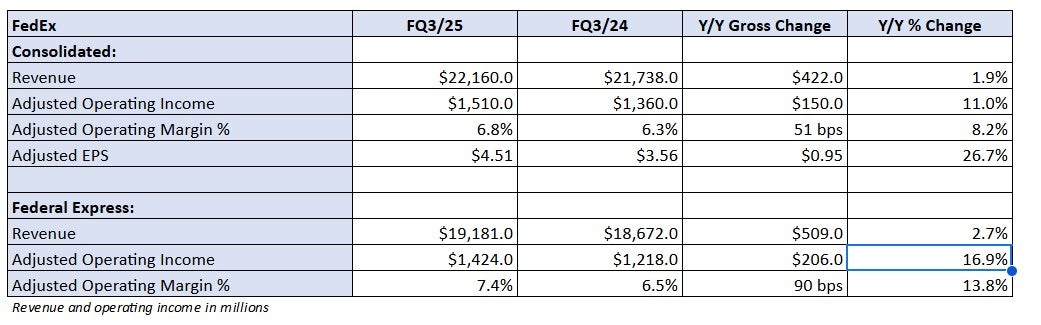

During the fiscal year third quarter ended Feb. 28, FedEx increased revenue 1.9% to $22.2 billion and delivered adjusted operating income of $1.5 billion, up 11% year over year, despite a compressed peak shipping season and severe weather events, including wildfires and winter storms, in North America. It was the first time revenue has increased so far since the start of the fiscal year in June.

Adjusted earnings per share missed consensus Wall Street estimates by 12 cents but were up 17% from the prior-year period, while revenue was better than predicted by $320 million.

The company attributed better profitability to three factors: the success of the Drive network transformation, which aims to permanently remove $4 billion in structural costs, including $2.2 billion during the current fiscal year, while improving customer service; higher pricing across the transportation segments; and higher volume at FedEx Express. During the quarter, FedEx achieved $600 million in cost savings from Drive.

FedEx Express, which is integrating its network with FedEx Ground, generated a 17% gain in adjusted operating income to $1.4 billion despite the significant negative impact from losing a domestic air cargo contract with the U.S. Postal Service. Express enjoyed greater U.S. and international export volume, which helped juice revenue 2.7% to $19.2 billion.

Operating results at FedEx Freight, which management said in December it would spin off into a separate less-than-truckload company, were pressured by lower fuel surcharges, reduced weight per shipment and fewer shipments. Operating income fell 23% to $261 million.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RELATED READING:

FedEx makes big push for third-party air cargo

Postal Service weighs serving as logistics partner for federal agencies

The post FedEx says economic uncertainty slowing parcel and freight demand appeared first on FreightWaves.