With grand and premier cru Burgundy prices falling or flatlining, regional wines are taking an increasingly large slice of the market as collectors clear out their cellars.

In Liv-ex’s

In Liv-ex’s annual

Burgundy Report, published in February, it was noted that 2025 has seen an uptick in Burgundy trade, particularly for regional wines. So what might be driving this?

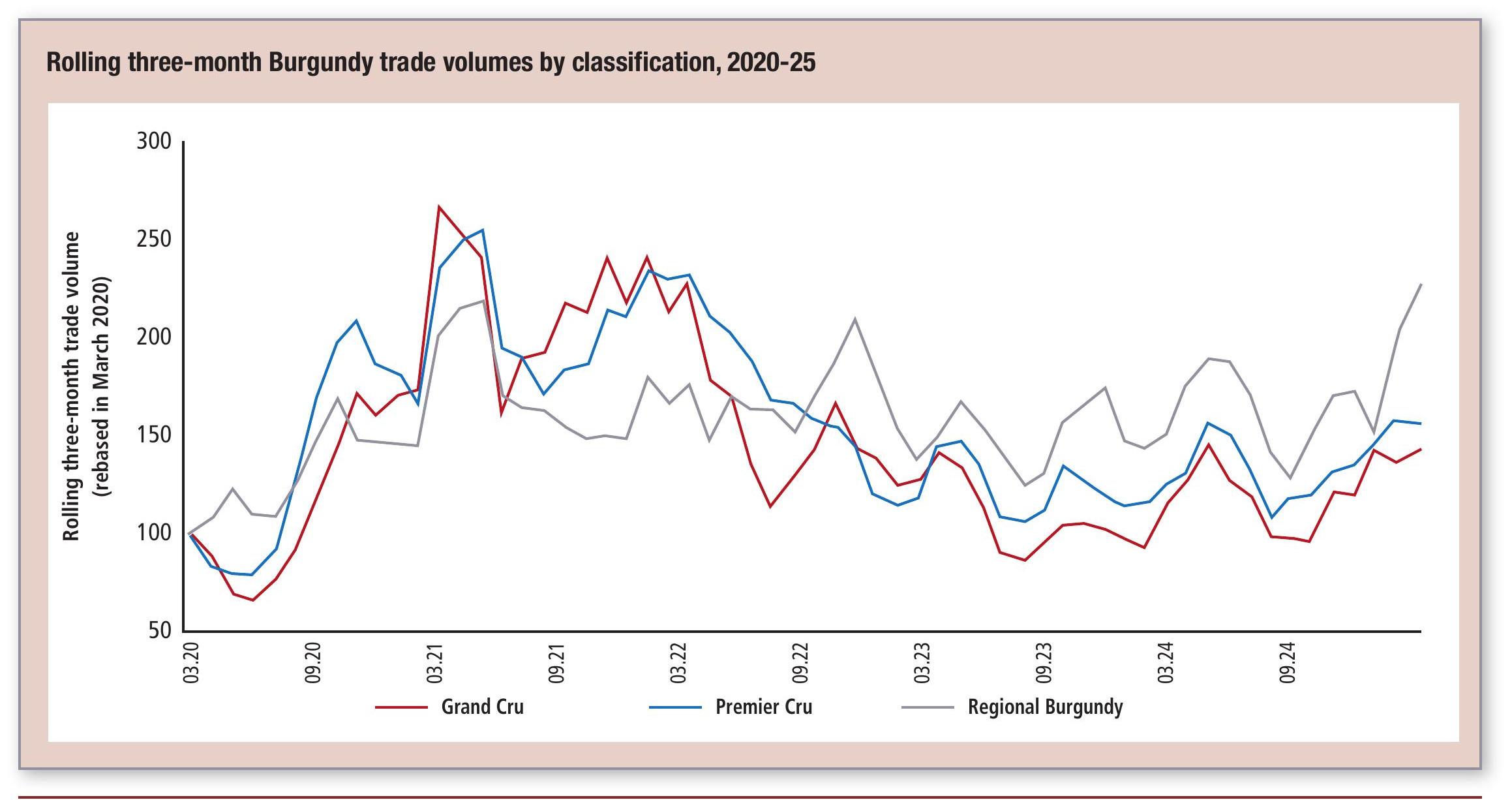

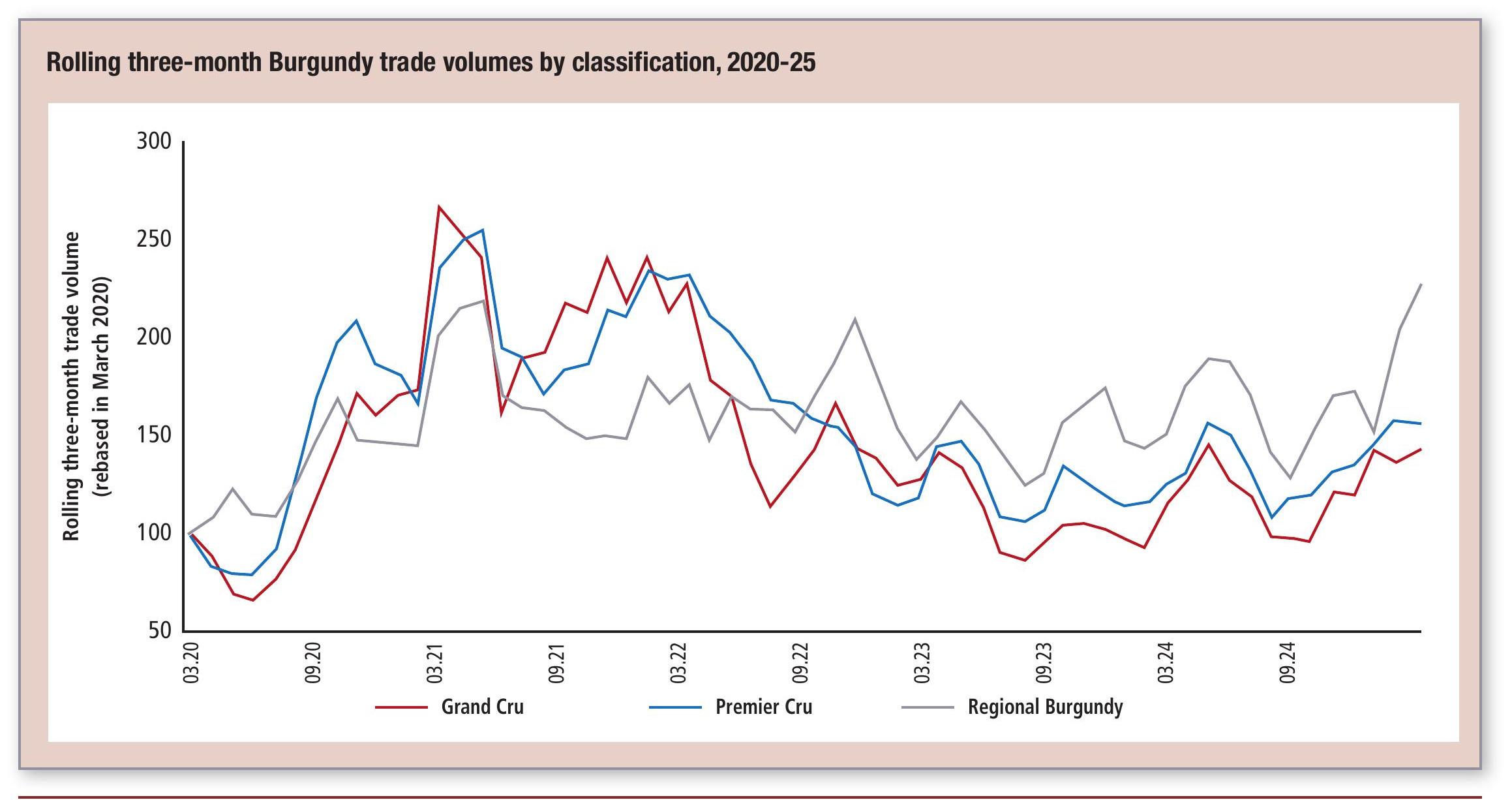

While indexed trading volumes for each of the three categories had tracked each other relatively closely since the turn of the market in late 2022, regional Burgundy has broken out since the start of 2025: 48.2% of Burgundy trade volumes year-to-date have been for regional wines, up from 39.4% in 2024, 39.1% in 2023, 34.3% in 2022, 29.0% in 2021 and 34.4% in 2020.

Average trade prices for grand cru Burgundy wines have consistently fallen over the past six months. Meanwhile, premier cru trade prices have flatlined, 23.5% down on where they were in March 2020 and 44.7% below their peak. Regional Burgundy trade prices, while more volatile, have not declined quite so far, but fell in February. All of this raises the question – is it buyers or sellers who are driving this rise in regional Burgundy trade volumes?

Since September, sellers have been increasingly responsible for regional Burgundy trade volumes, triggering trades that accounted for 69.9% of volumes in February. In February 2024, this figure stood at just 19.4%.

Stockholders appear to be committing to clearing out cheaper reg

ional Burgundy from their cellars before they turn their attention to their more expensive lines. This is reflected in the cheapest 20% of Burgundy wines accounting for the greatest share of any price bucket year-to-date.

However, with the lower end still accounting for a tiny fraction of Burgundy’s total trade value, the question remains: will this clear-out of lowerend stock really make much difference?

About Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at:

www.liv-ex.com

In Liv-ex’s annual Burgundy Report, published in February, it was noted that 2025 has seen an uptick in Burgundy trade, particularly for regional wines. So what might be driving this?

While indexed trading volumes for each of the three categories had tracked each other relatively closely since the turn of the market in late 2022, regional Burgundy has broken out since the start of 2025: 48.2% of Burgundy trade volumes year-to-date have been for regional wines, up from 39.4% in 2024, 39.1% in 2023, 34.3% in 2022, 29.0% in 2021 and 34.4% in 2020.

Average trade prices for grand cru Burgundy wines have consistently fallen over the past six months. Meanwhile, premier cru trade prices have flatlined, 23.5% down on where they were in March 2020 and 44.7% below their peak. Regional Burgundy trade prices, while more volatile, have not declined quite so far, but fell in February. All of this raises the question – is it buyers or sellers who are driving this rise in regional Burgundy trade volumes?

Since September, sellers have been increasingly responsible for regional Burgundy trade volumes, triggering trades that accounted for 69.9% of volumes in February. In February 2024, this figure stood at just 19.4%.

In Liv-ex’s annual Burgundy Report, published in February, it was noted that 2025 has seen an uptick in Burgundy trade, particularly for regional wines. So what might be driving this?

While indexed trading volumes for each of the three categories had tracked each other relatively closely since the turn of the market in late 2022, regional Burgundy has broken out since the start of 2025: 48.2% of Burgundy trade volumes year-to-date have been for regional wines, up from 39.4% in 2024, 39.1% in 2023, 34.3% in 2022, 29.0% in 2021 and 34.4% in 2020.

Average trade prices for grand cru Burgundy wines have consistently fallen over the past six months. Meanwhile, premier cru trade prices have flatlined, 23.5% down on where they were in March 2020 and 44.7% below their peak. Regional Burgundy trade prices, while more volatile, have not declined quite so far, but fell in February. All of this raises the question – is it buyers or sellers who are driving this rise in regional Burgundy trade volumes?

Since September, sellers have been increasingly responsible for regional Burgundy trade volumes, triggering trades that accounted for 69.9% of volumes in February. In February 2024, this figure stood at just 19.4%.

.jpg)