Using real-time data to navigate today’s volatile tariff landscape

Rapid policy decisions are transforming freight flows. The post Using real-time data to navigate today’s volatile tariff landscape appeared first on FreightWaves.

The Trump administration’s tariffs – and our trading partners’ various responses to them – have sent shockwaves through global supply chains, driving volatility and spreading uncertainty for freight market participants. As tariffs reshape trade flows and impact everything from trucking capacity to ocean freight rates, supply chain professionals are grappling with a rapidly changing landscape that demands agility and data-driven decision making.

“The speed and unpredictability of recent tariff actions have caught many in the industry off guard,” says Craig Fuller, founder and CEO of SONAR. “Companies are scrambling to adapt their supply chains and procurement strategies, often with limited visibility into how market conditions are shifting.”

This is where high-frequency freight data becomes an invaluable asset. Platforms like SONAR that provide real-time insights into freight market dynamics allow carriers, shippers and brokers to detect changing conditions as they unfold and to react swiftly.

For carriers, granular data on tender rejection rates, spot rates and volume across lanes enables more strategic capacity deployment and pricing. Shippers can leverage this intelligence to secure capacity and favorable rates before wider market awareness drives up costs. Meanwhile, brokers gain a competitive edge through enhanced market visibility that helps them connect supply and demand more efficiently.

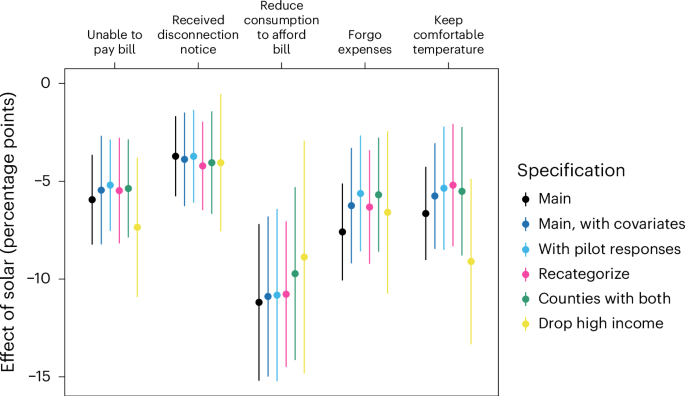

The impacts of tariffs are already evident in SONAR data:

- Canadian trucking capacity has tightened significantly, with outbound tender rejection rates spiking from 4.8% in January to 10.1% currently as shippers rush to move freight ahead of potential tariffs.

- U.S. flatbed rejection rates have more than doubled from 10% to 24% in recent weeks, driven largely by efforts to transport Canadian lumber before tariffs take effect.

- Ocean spot rates from China to the U.S. have plummeted to 52-week lows, down 59% to the West Coast and 45% to the East Coast since the start of the year, even as ocean container bookings into the U.S. are elevated due to retailers pulling inventory forward.

- Air cargo rates are nearing early 2020 levels as policy shifts like the closing of the de minimis loophole threaten to impact low-value shipments.

“What we’re seeing in the data is a rush to pull forward inventory and a reevaluation of sourcing strategies,” notes Zach Strickland, SONAR’s director of freight market intelligence. “Companies are moving quickly to mitigate tariff impacts, which is creating significant volatility in freight flows and rates across modes.”

In general, shippers and especially retailers are importing elevated freight volumes out of an abundance of caution with regard to tariffs and unpredictable policy shifts, not due to heightened consumer demand or industrial production. That’s why expensive, fast transportation like truckload and air cargo are seeing weak volumes, while cheaper, slower modes such as ocean container and rail intermodal are experiencing higher volumes, albeit with very little upward pressure on rates.

(The Freightos Baltic Daily Index – China to North America West Coast in white [right y-axis] represents an ocean container spot rate measured in U.S. dollars per forty-foot equivalent unit. The National Truckload Index – USA in yellow [left y-axis] is a national average spot rate based on bookings data 24 hours old or less. Chart: SONAR. To learn more about SONAR, click here)

This volatility underscores the importance of high-velocity data in today’s freight markets. Static reports and outdated intelligence are no longer sufficient in an environment where conditions can change dramatically in a matter of days or even hours. In these situations, shippers can find themselves either without needed capacity or grossly overpaying for freight, depending on the mode and geography. Opaque market conditions tend to benefit intermediaries to their customers’ detriment. SONAR’s data can help make markets more transparent.

“The ability to detect and respond to market shifts in real time is now a critical competitive advantage,” says Fuller. “Companies that leverage high-frequency data to inform their strategies will be far better positioned to navigate the uncertainty and volatility created by shifting trade policies.”

As the tariff situation continues to evolve, freight market participants must prioritize agility and data-driven decision making. By harnessing the power of real-time freight intelligence, industry players can turn market turbulence into opportunity – reacting faster than competitors to secure capacity, optimize networks and ultimately deliver greater value to customers.

The freight markets have entered a new era of volatility and complexity. But with the right data and analytics, supply chain professionals can cut through the noise and uncertainty to make better, faster decisions. To stay informed about SONAR’s data and supply chain volatility, click here.

The post Using real-time data to navigate today’s volatile tariff landscape appeared first on FreightWaves.

![A vibe check on the Sea Air Space conference, plus key points from SecNav’s speech [VIDEO]](https://breakingdefense.com/wp-content/uploads/sites/3/2025/04/phelan-shaking-scaled-e1744233372839.jpg?#)