Trucks make January run for the border at railroads’ expense

Railroads in January saw their share of North American transborder trade slip as trucks posted double-digit gains. The post Trucks make January run for the border at railroads’ expense appeared first on FreightWaves.

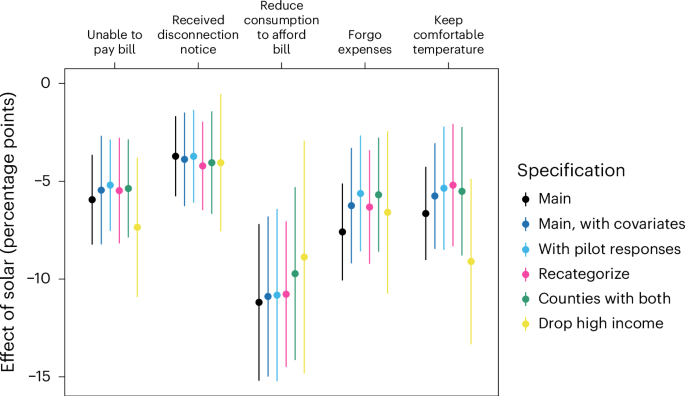

North American transborder freight carried by railroads declined in January from the same month the previous year even as shipments hauled by trucks increased by double digits.

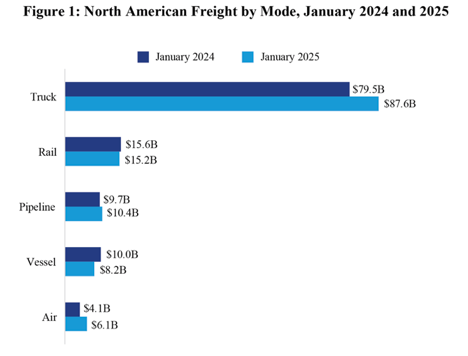

Overall transborder freight totaled $134.4 billion in January, the Bureau of Transportation Statistics (BTS) said, an increase of 8.2% from January 2024.

Railroads moved $15.2 billion of that, down 2.7% y/y, while trucks accounted for $87.6 billion, up 10.2%.

While January historically is a slack period for most freight, those issues were magnified for Canadian railroads CN (NYSE: CNI) and CPKC (NYSE: CP), which struggled with dwell times moving intermodal containers out of the busy western ports.

At the same time, truck volumes improved at both borders as logistics planners looked to stay ahead of looming U.S. tariffs.

Among other modes tracked by BTS, pipelines moved $10.4 billion of freight, up 7%; vessels moved $8.2 billion, down 18.3%; and $6.1 billion moved by air, up 48.3%.

Freight moving between the United States and Canada totaled $64.8 billion, up 8.6% from January 2024. Freight between the U.S. and Mexico was $69.6 billion, up 7.9%.

U.S.-Canada (both directions)(Dollars in Billions) U.S.-Mexico (both directions)(Dollars in Billions) Truck $35.6 Truck $52 Pipeline $9.6 Rail $7.4 Rail $7.8 Vessel $5.3 Vessel $2.9 Air $2.1 Air $4 Pipeline $0.8

Detroit and Port Huron, Michigan, and Buffalo, New York, are the top truck ports for U.S. freight flows with Canada, while Laredo and El Paso, Texas, and Otay Mesa, California, are the top truck ports with Mexico. Detroit, Port Huron and International Falls, Minnesota, are the top rail connection ports for U.S. freight flows with Canada, while Laredo, El Paso and Eagle Pass, Texas, are the top rail connection ports with Mexico.

| U.S.-Canada Trade Breakdown | U.S.-Mexico Trade Breakdown |

| Top three rail US-Canada rail ports | Top three US-Mexico rail ports | ||

| Detroit | $2.2 billion | Laredo, TX | $3.7 billion |

| Port Huron, MI | $1.8 billion | Eagle Pass, TX | $2.1 billion |

| Int’l Falls, MN | $1 billion | Nogales, AZ | $0.7 billion |

Breakdown of transborder trade

Top three truck ports Top three truck ports Detroit $8.6 billion Laredo, TX $23.2 billion Port Huron, MI $7.3 billion El Paso-Ysleta, TX $7.7 billion Buffalo, NY $6.3 billion Otay Mesa, CA $4.9 billion Top three truck commodities Top three truck commodities Computers/parts $5.5 billion Computers/parts $13 billion Vehicles/parts $4.6 billion Electrical machinery $11.4 billion Precious metals $2.4 billion Vehicles/parts $6.7 billion Top three rail commodities Top three rail commodities Vehicles/parts $2.6 billion Vehicles/parts $3.6 billion Mineral fuel $0.8 billion Beverages/spirits $0.7 billion Plastics $0.6 billion Computer machinery $0.5 billion

Subscribe to FreightWaves’ Rail e-newsletter and get the latest insights on rail freight right in your inbox.

Find more articles by Stuart Chirls here.

Related coverage:

Mexico boosted CPKC, FXE in 2024 as other railroads saw weaker revenue

Bring It Home: Norfolk Southern boosts industrial collaborations by enhancing infrastructure

Union Pacific in partnership for Kansas City shortline railroad

Norfolk Southern expands portfolio of certified rail-served industrial sites

The post Trucks make January run for the border at railroads’ expense appeared first on FreightWaves.

![A vibe check on the Sea Air Space conference, plus key points from SecNav’s speech [VIDEO]](https://breakingdefense.com/wp-content/uploads/sites/3/2025/04/phelan-shaking-scaled-e1744233372839.jpg?#)