Orderful report: Trucking recovering, but specialized markets still volatile

A performance analysis by Orderful of different equipment types highlights strengths and challenges across the market. The post Orderful report: Trucking recovering, but specialized markets still volatile appeared first on FreightWaves.

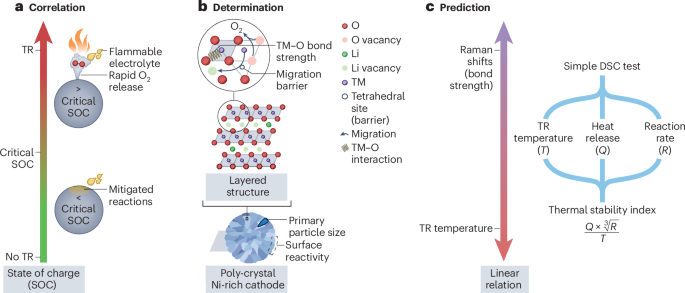

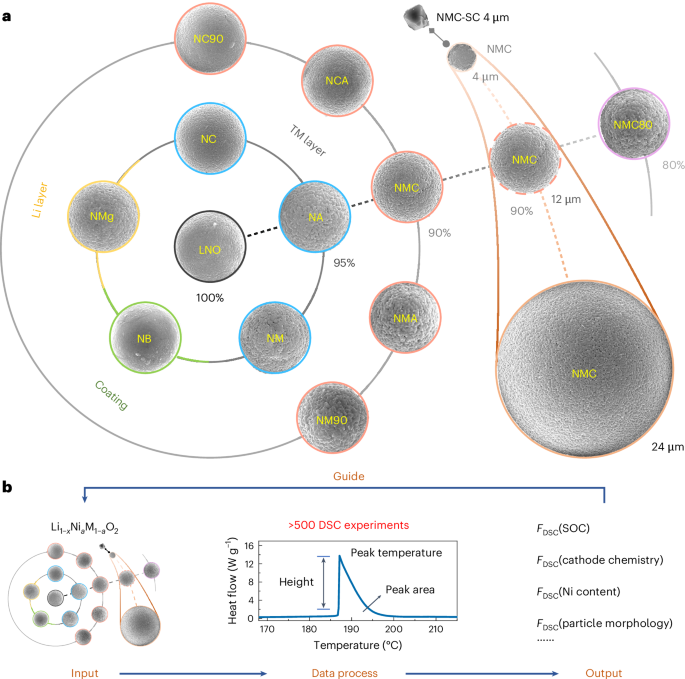

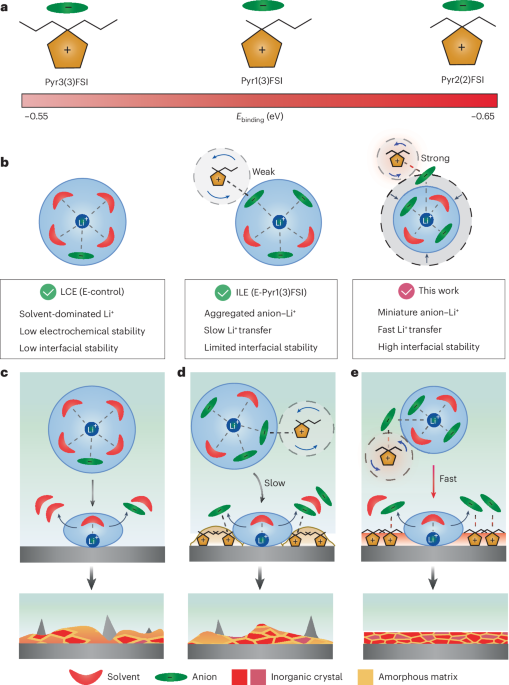

Integration platform Orderful recently released its “2025 Carrier Performance Trends” report, offering an analysis of trucking industry trends based on the company’s electronic data interchange transactions.

“Trucking has faced historic challenges in recent years, but our latest EDI data signals a turning point. While signs of recovery are promising, the data also highlights ongoing risks around market concentration and seasonal volatility,” Erik Kiser, founder and CEO of Orderful, explained in the release.

While comparing month-over-month data from 2024, the report revealed ongoing market volatility, highlighting the need for adaptability. Sharp contrasts between summer lows and fall rebounds demonstrated how seasonal factors continue to influence the market’s trajectory. This fluctuation shows the importance of preparing for seasonal shifts while leveraging rebound periods for growth opportunities.

“These fluctuations underscore a crucial insight about the industry’s recovery: it isn’t following a simple upward path but rather adapting to both seasonal patterns and structural changes. The strong October performance, coming after September’s dip, suggests that carriers are learning to navigate these cycles more effectively,” the report stated.

The performance analysis of different equipment types highlights varied strengths and challenges across the market.

“This specialization creates a double-edged sword. On one hand, the high barriers to entry and specialized expertise required have helped established reefer carriers maintain stability through market turbulence. On the other, this same concentration may limit flexibility as the market evolves,” the report suggested.

SONAR data has backed this insight, with recent reefer outbound tender rejection rates and spot market rates continuing to decline while remaining stronger than in the past two years. This decline follows seasonal trends, driven by a steady drop in reefer tender volumes. The Reefer Outbound Tender Volume Index (ROTVI) fell 8.31% from January to February with a brief volume increase in mid-February quickly fading.

Lower volumes and rejection rates have pushed reefer spot rates down, which is linked to excess reefer capacity. A U.S. Department of Agriculture report noted adequate truck availability across most U.S. regions, with surpluses in key areas like South Texas and Washington state.

Flatbeds have also struggled with adaptability in the market, according to the report. With 91% of shipments relying on standard configurations, the segment faces difficulties in responding quickly to market fluctuations.

However, the specialized trailer market is also showing signs of replicating conditions from three years ago, with a recent spike in tender rejections.

Lastly, the tanker market experienced the most dramatic volatility due to its highly specialized nature. Significant swings in monthly performance reflect strong seasonal patterns in this segment as well.

“The data shows striking swings from -31% in February [2024] to a peak of 36.4% in July [2024], reflecting strong seasonal patterns driven primarily by petroleum shipments and summer gasoline demand,” the report explained.

The report highlights the trucking industry’s ongoing recovery and the critical balance between specialization and adaptability.

Carriers and shippers must strategically adapt to seasonal demand shifts to maintain efficiency. While market trends indicate the worst of the downturn may be over, long-term success requires flexibility and strong partnerships between the two groups.

Freight demand fluctuates throughout the year, making planning essential.

Since specialized equipment often experiences seasonal vulnerabilities, carriers should consider utilizing trailer networks for sustainable scaling and consistent service levels.

For example, the report points to 13% of temperature-controlled shipments being run by nonreefer assets, showcasing shippers leveraging van trailer capacity in times when climate or weather trends support using the nontraditional trailer type.

For shippers with more specialized freight, look to partner with logistics providers who can connect you with specialized carriers when the season calls for it, while avoiding overdedicating yourself to a single provider when specialized capacity gets tight.

Global manufacturing is repositioning — but it’s complicated

RueData secures seed round for tire optimization platform

SONAR partners with project44 on new procurement analytics product

The post Orderful report: Trucking recovering, but specialized markets still volatile appeared first on FreightWaves.