fine wine monitor – in association with Liv-ex

Nearly halfway through the third year of the current down market, the wine trade is undoubtedly in need of respite. While we cannot know for sure where and when prices will find their floor, turning to previous market cycles can provide some precedence of what to expect.

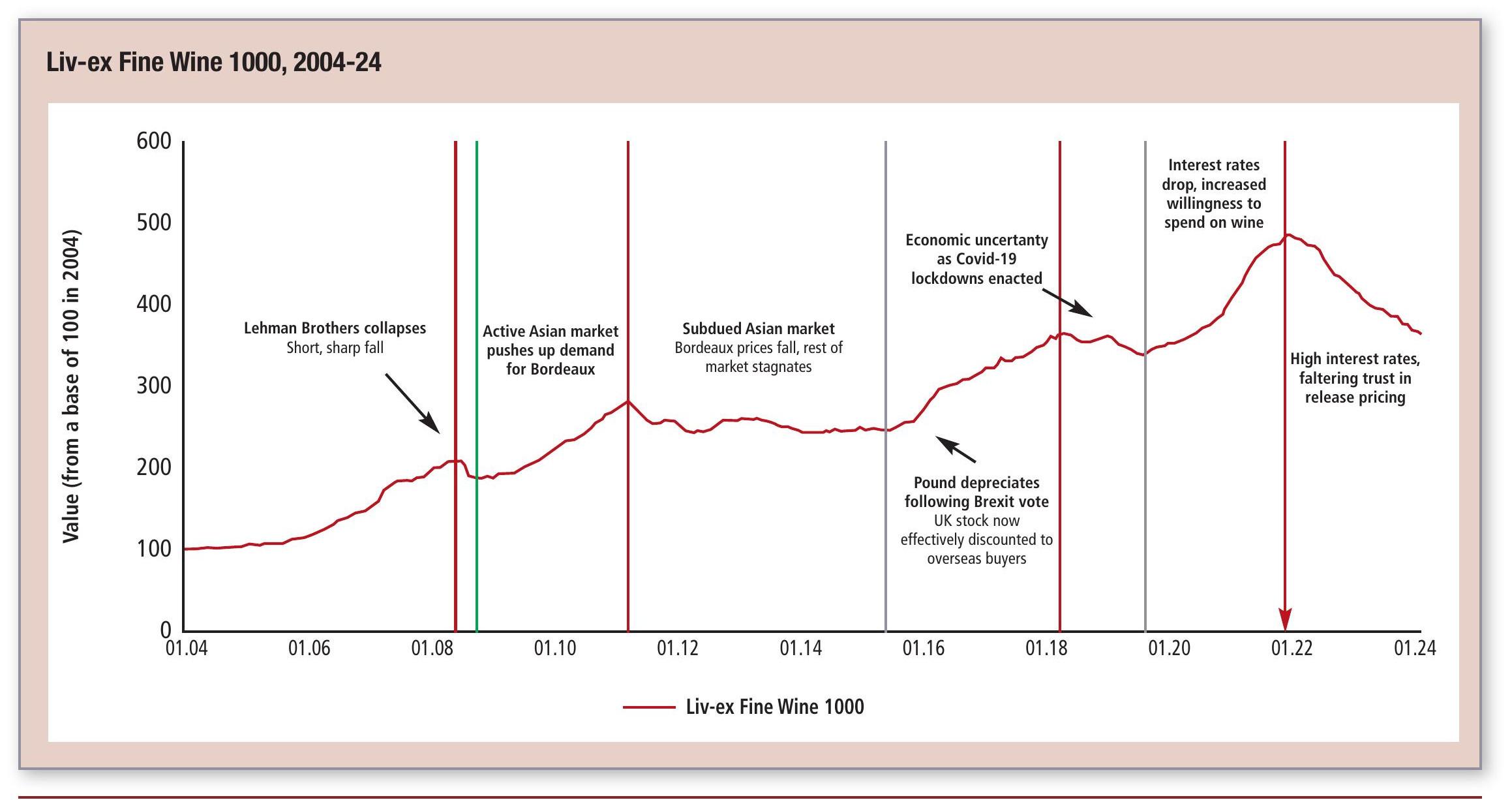

As the recent history shows, from May 2020 to November 2022, the Liv-ex Fine Wine 1000 rose 43.7%. In length and gradient, this up market was not dissimilar to those of 2016-19 and 2009-11, albeit more extreme. The current downturn, however, appears much harsher and more prolonged than any historical examples. Before now, the Fine Wine 1000 had never fallen by more than 13.2%, or had downturns lasting for more than 16 consecutive months.

The current downturn is set apart by its breadth – none of the Liv-ex 1000 sub-indices has been immune – but there are historical instances of this kind of cycle.

Lessons from the Fine Wine 50

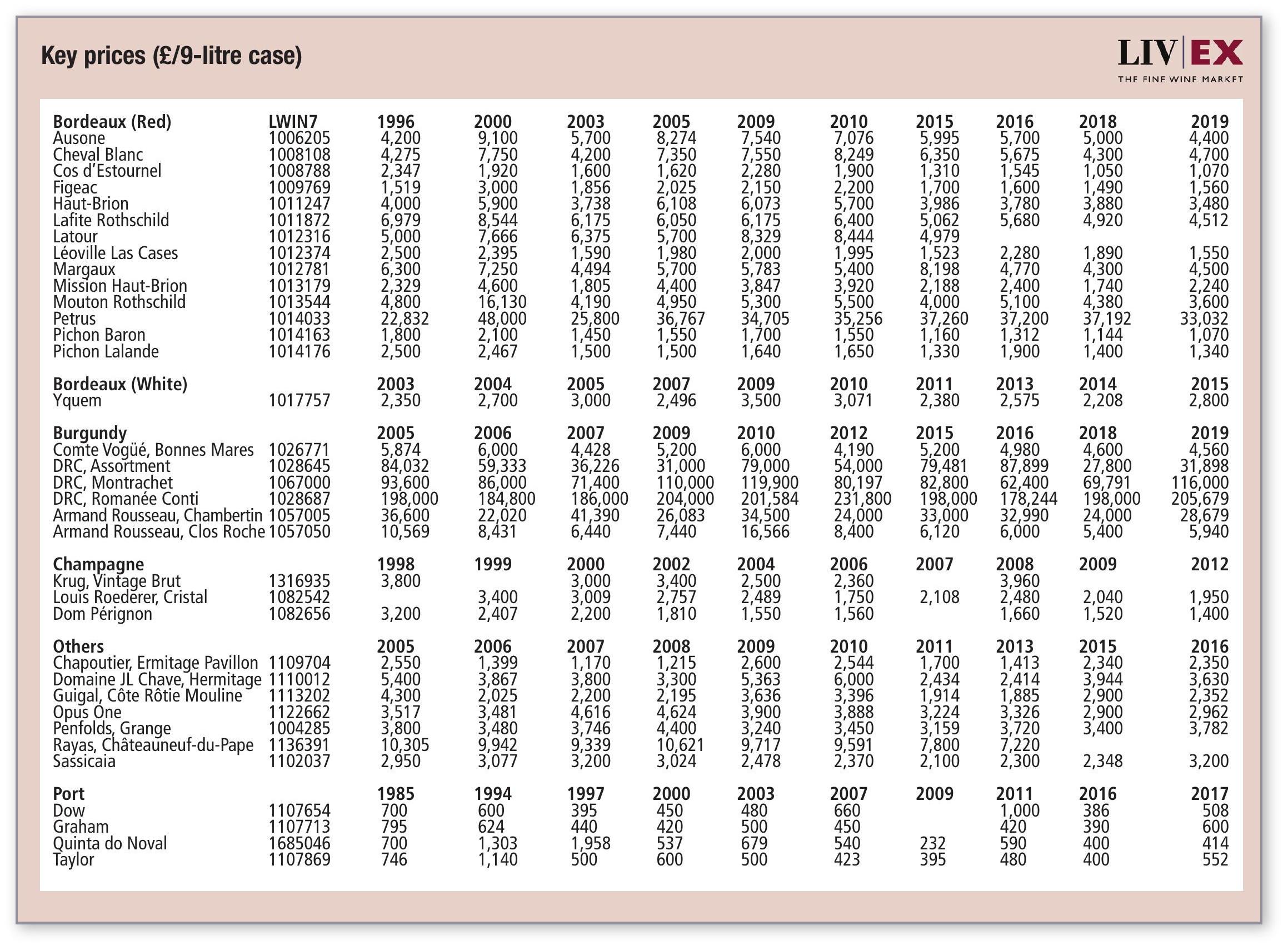

During Bordeaux’s 2009-2011 bull run, the Fine Wine 50 rose 113.9%. This was partially justified by high demand, driven largely by a very active Chinese market. Bordeaux’s first growths capitalised on this surge by ramping up release pricing. Château Lafite Rothschild, which proved especially popular, increased its ex-London release price from £1,850 per case for the 2008 vintage to £11,000 for 2009. This pricing proved over zealous. Once the Chinese market withdrew, secondary market prices began to fall, and only stabilised once they’d reached their pre-boom prices.

The Fine Wine 50 took time to recover, quickly retracing 47.6% of its initial move up from July 2011 to January 2012, but eventually finding its floor in 2014, at its 2008 peak (a 76.4% retracing).

The role of external factors

Just as Bordeaux’s price hikes were caused by the reinvigorated entrance of the Asian market, the steep rise of the Liv-ex 1000 in 2020 was driven by outside interventions – monetary easing and the changing of consumer habits during Covid-19 lockdowns. In this sense, both the 2009-11 and 2020-22 bull runs were artificially created by external factors, and exaggerated by release pricing. In other words, while we should expect to see long-term upward trends in the fine wine market, spikes of this magnitude were unsustainable.

Just as the Fine Wine 50 and other affected indices have returned to pre-2009 levels, we have seen the prices of many wines return to pre-Covid levels.

What happens next?

Following the lengthy 2011-13 downturn, prices did not immediately rise. Having lost considerably on Bordeaux purchased at or near the peak, merchants were understandably reluctant to commit to price increases. A recovery period was needed before prices could rise once again. They remained at this floor for over a year. While no other region saw such pronounced price increases, all fell victim to the stagnant period that followed.

Although more bullish market participants may be hoping for a swift price recovery in the coming months and years, a sideways-moving market may be a blessing in disguise. With a growing need to draw in the next generation of fine wine consumers, a period of price stability could invigorate the necessary demand to clear out an excess of stock.

Some of the Liv-ex 1000’s sub-indices will have further yet to fall before their components present value to buyers. Nonetheless, in some cases, and at the broadest level, key support levels are in sight.

About Liv-Ex

Liv-ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at:

www.liv-ex.com

As the recent history shows, from May 2020 to November 2022, the Liv-ex Fine Wine 1000 rose 43.7%. In length and gradient, this up market was not dissimilar to those of 2016-19 and 2009-11, albeit more extreme. The current downturn, however, appears much harsher and more prolonged than any historical examples. Before now, the Fine Wine 1000 had never fallen by more than 13.2%, or had downturns lasting for more than 16 consecutive months.

The current downturn is set apart by its breadth – none of the Liv-ex 1000 sub-indices has been immune – but there are historical instances of this kind of cycle.

As the recent history shows, from May 2020 to November 2022, the Liv-ex Fine Wine 1000 rose 43.7%. In length and gradient, this up market was not dissimilar to those of 2016-19 and 2009-11, albeit more extreme. The current downturn, however, appears much harsher and more prolonged than any historical examples. Before now, the Fine Wine 1000 had never fallen by more than 13.2%, or had downturns lasting for more than 16 consecutive months.

The current downturn is set apart by its breadth – none of the Liv-ex 1000 sub-indices has been immune – but there are historical instances of this kind of cycle.

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com