Billables Are Not The Same As Cash Flow. Here’s Why That’s Important.

[Sponsored] Findings from the MyCase 2025 Legal Industry Report. The post Billables Are Not The Same As Cash Flow. Here’s Why That’s Important. appeared first on Above the Law.

You’ve established yourself as an authority in your field. Your firm can be found at the top of the search results for lawyers in your area. New clients keep coming through your door, and your billable hours continue to grow.

Which leaves you confused: With all of this business, how can your firm be struggling to turn a profit — or even pay your bills?

If you find yourself in this unenviable situation, you can take comfort in two realities.

The first is that you’re not alone. In fact, 68% of law firms cite collecting fees as a major hurdle, according to the 2025 Legal Industry Report from MyCase, suggesting an industrywide disconnect between billable hours and the bottom line.

The second is that it doesn’t have to be this way.

Here, we’ll explore how law firms that experience cash flow problems can change this situation — and how already-profitable firms can do even better.

How Busy Firms Find Themselves in the Red

It’s often stated that law schools don’t teach business management, and, as a result, your legal training ends where your efforts to become profitable begin. Additionally, most lawyers pursued their career path out of a desire to solve life-changing problems for their clients, not to balance a bank ledger.

This dynamic can be especially problematic in an industry that poses unique accounting and business challenges.

When it comes to revenue, clients have short memories, so the longer a bill is delayed (and the larger it grows), the more challenging it becomes to collect. The awkwardness of following up to get paid can dissuade some lawyers from even taking these steps, and that’s assuming you actually billed for the time you worked, to begin with.

It’s a common scenario.

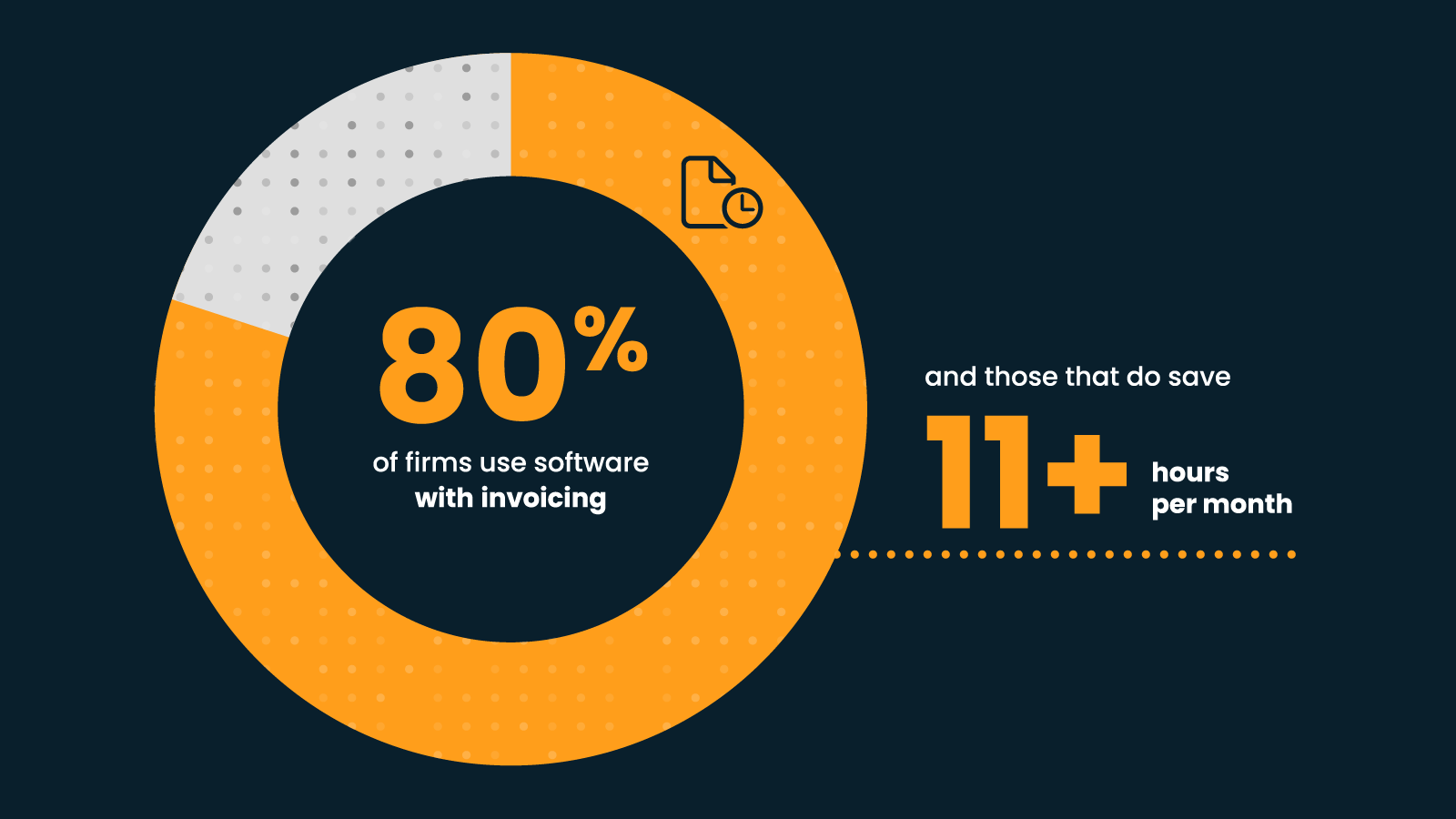

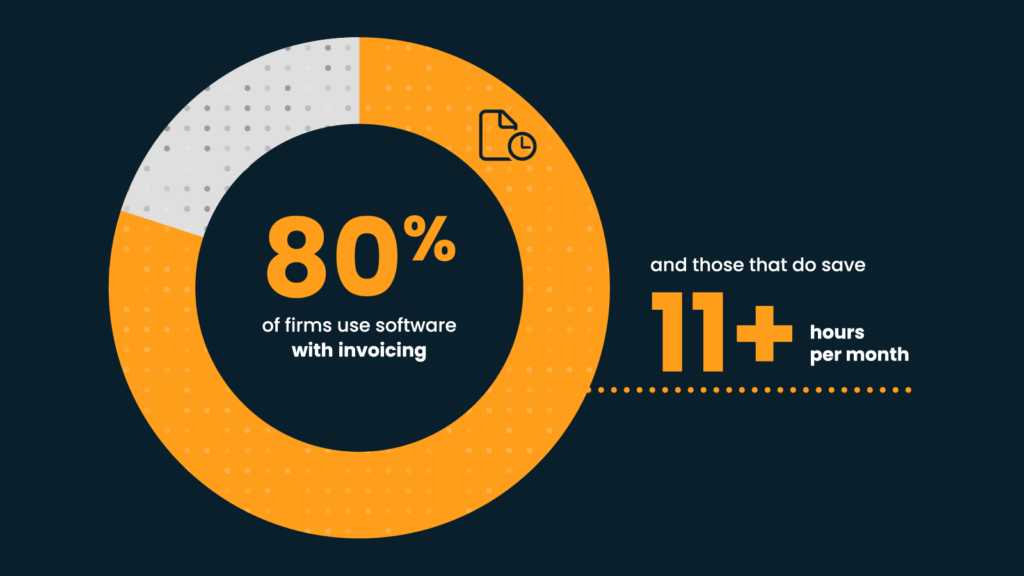

According to MyCase’s Legal Industry Report, 53% of firms report invoicing as a challenge, and 55% struggle with time tracking. Firms that do not optimize billing and collections lose 11+ hours per month simply from inefficiencies in time tracking and invoicing.

And that’s just the beginning.

Try managing your finances while adding in the complexities of IOLTA-compliant accounting, or managing your budget for spending, or preparing for seasonal fluctuations in revenue, or navigating broader economic forces.

The bottom line: If you want to maintain a financially viable firm amid these challenges, the business strategy can’t be an afterthought. You must develop an ongoing plan to maintain a healthy cash flow — not just a steady stream of billable work.

Here are three steps you can take right now to make it happen.

No. 1: Automate Invoicing and Payment Reminders

The fundamental key to collecting the money you’re owed is simple: You must follow up on unpaid bills.

While no one likes chasing down clients for their invoices, failing to do so can lead to serious problems as unpaid fees grow, and automation can be the cure.

(Here, AffiniPay’s Claude Ducloux shares insights on how delays can make collection more difficult.)

Encouragingly enough, the legal industry is taking steps to address this problem. According to the 2025 Legal Industry Report, 80% of firms now use software with invoicing capabilities, and those that do save 11+ hours per month.

Behind on your billing operation? Feel free to sign up for a free trial of MyCase’s billing solutions here.

No. 2: Offer Online Payments

As the Legal Industry Report demonstrates, accepting payments through an online system is table stakes for a modern firm.

According to the report, 82% of law firms accept credit/debit card payments through online payment software. Additionally, 59% of firms report improved collection rates when offering flexible, digital payment options, and 28% collect significantly more fees using these tools.

One sticking point may be the surcharge. Here, Claude explains why he avoids these at his firm.

The bottom line: If you’re not currently offering online payments, you should explore doing so now.

MyCase and LawPay, which have combined to create the most comprehensive legal practice management and payments platform, can help. Explore our legal payments software here.

No. 3: Use Passive Time-Tracking Tools

While just about all of your competitors have already embraced the online payment option, passive time-tracking tools represent one area where you can still get ahead.

Time tracking software automatically records your billable hours, allowing you to spend more time on billable work and less on administrative tasks like recording your time. It also allows you to document billable hours that would otherwise fall through the cracks.

Working within your practice management software, these systems can generate invoices directly from the billable work they record, benefiting your bottom line in many ways.

According to the Legal Industry Report, only 24% of firms currently use passive time tracking, yet of those that do, 56% report measurable time savings.

Learn more about MyCase’s Smart Time Finder here.

A Financially Viable Firm

If your firm isn’t actually collecting the fees it’s earned, its billable hours are little more than numbers in a spreadsheet.

While you may be highly skilled in your practice area — and you may be attracting an enviable client base — this alone will not ensure your success.

To achieve financial wellness, you need to follow through on your work: from tracking your hours to collecting the money you’re owed to accounting for all of your expenditures.

Is your firm ready to stop leaving money on the table? Automate, track smarter, and get paid faster — with solutions built for law firms.

Feel free to sign up for a free trial of the full MyCase system here.

The post Billables Are Not The Same As Cash Flow. Here’s Why That’s Important. appeared first on Above the Law.