President Trump’s tariff moves have piled more pressure on a fragile fine wine market, with US buyers taking a hit.

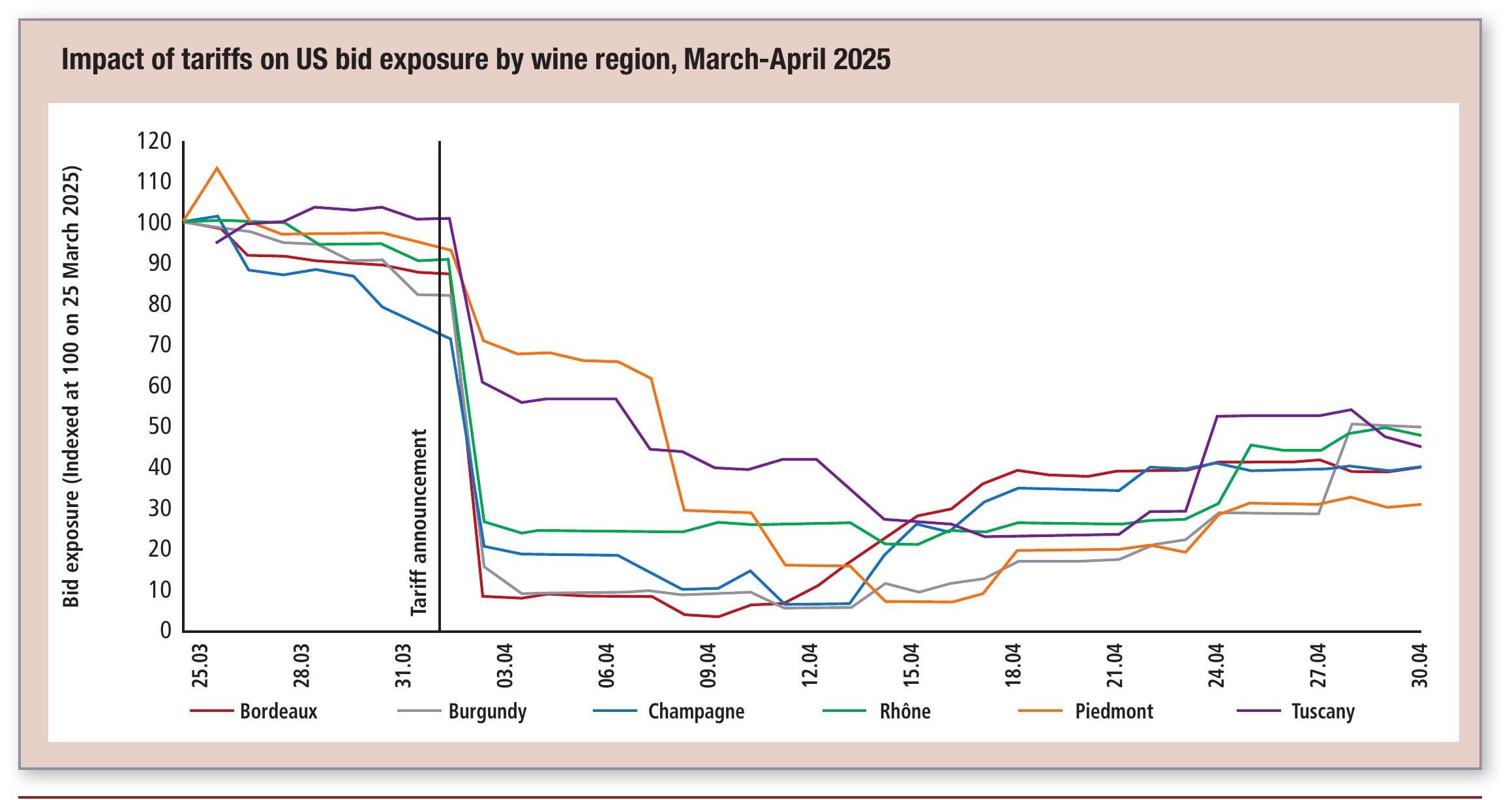

Following President Trump’s tariff announcement on 2 April, Liv-ex anticipated three possible phases: US greatly reduces buying for a period; the reduction in demand prompts a further fall in prices; US buyers come back when stock is required.

As expected, US buying and, subsequently, prices fell sharply during April.

US BID EXPOSURE RETURNS (TO SOME DEGREE)

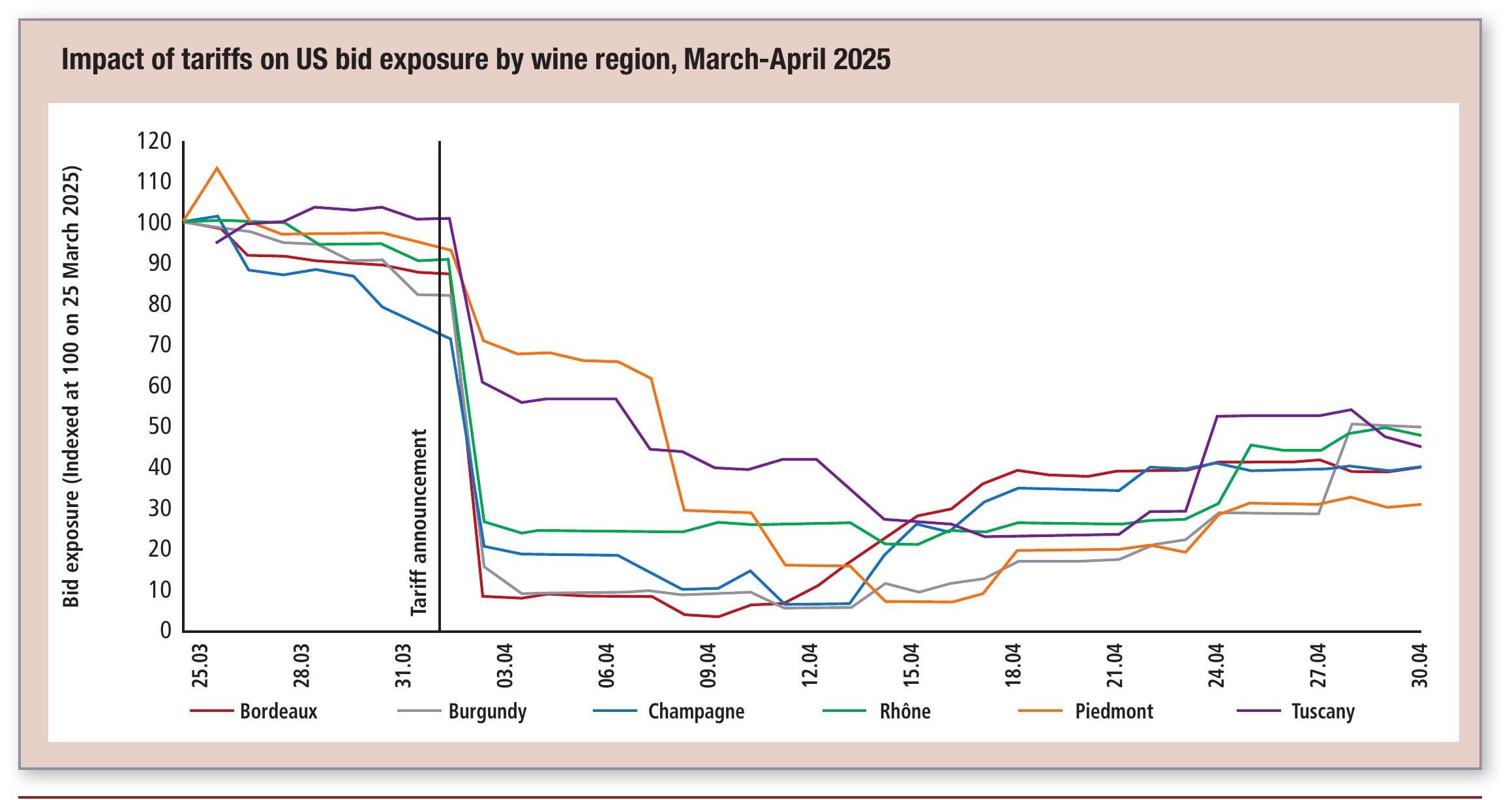

While US buyers continue to take more of a back seat, US bid exposure has, on the whole, ticked back up since mid-April. This makes sense. Once enough time elapsed for risk assessments to be completed, decisions to be taken on what percentage of the tariff to absorb, and a communication of one’s position to customers, one would expect some demand to rekindle.

Nevertheless, for each major wine region, total bid exposure is at least 50% below its pre-tariff level. In particular, US bid exposure for Piedmont has so far stayed the furthest below its previous levels.

US BID EXPOSURE BY WINE REGION

US buyers didn’t wait until the announcement on 2 April to drop the value of their bids. They started after the threat of 200% tariffs on 13 March, before pulling most of them completely immediately after 2 April. Where they have returned their bids, they have tended to bring them back at lower levels.

US DOLLAR WEAKNESS

However, while tariffs sit at 10% until 9 July, a weaker dollar is another problem with which US buyers have to contend. Despite rising off the back of the temporary reduction in tariffs on China on 12 May, the US$:euro exchange rate still sits below the pre-tariff level.

WHAT HAS THE US BEEN BUYING?

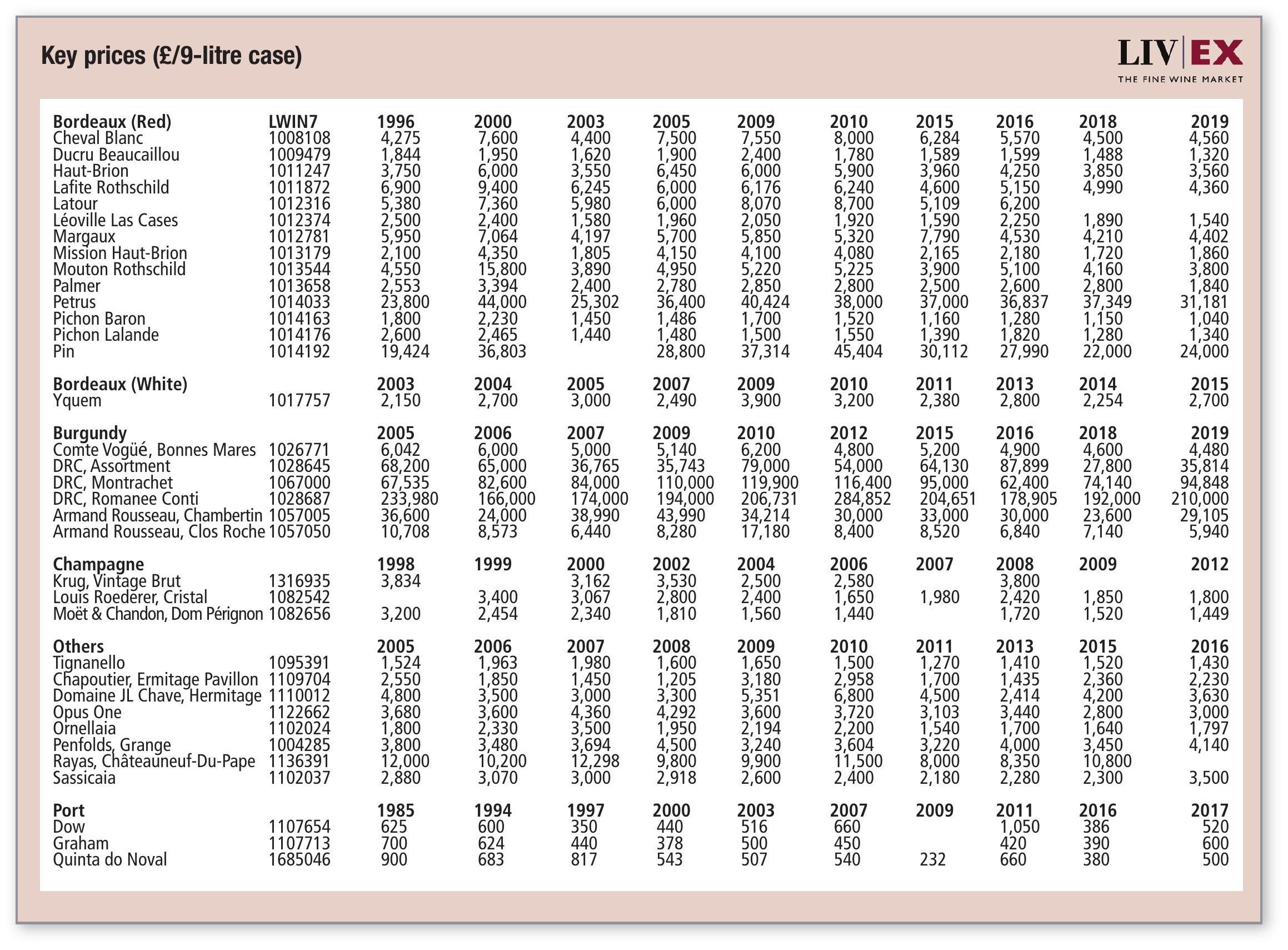

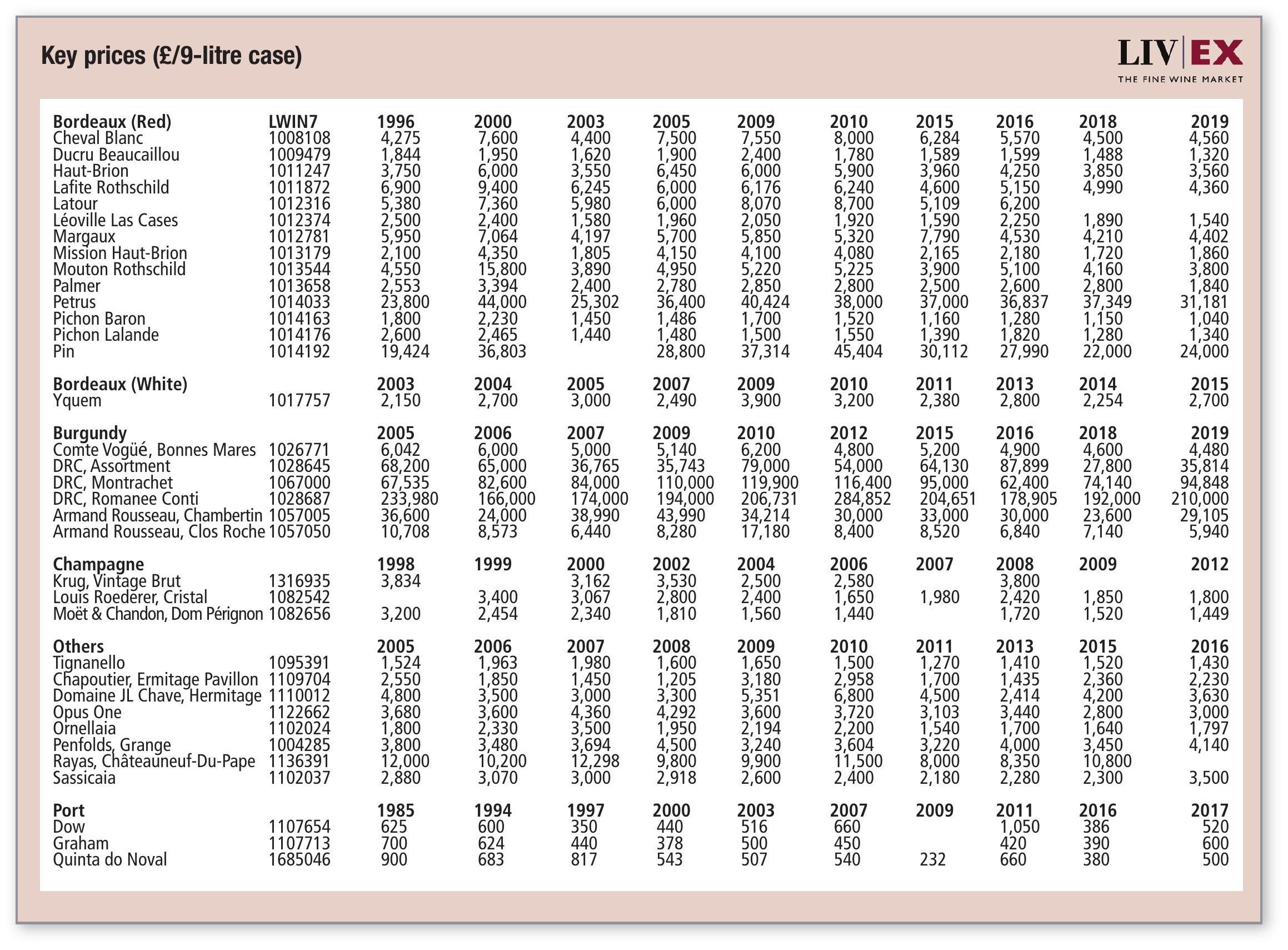

Interestingly, Liv-ex saw Bordeaux’s share of total US purchase value rise in April, with the region accounting for 43.3% of all US purchases, well above the average recent share.

CONCLUSION

While the 90-day reduction in EU wine tariffs has brought some temporary respite, the situation remains one of severe uncertainty. For instance, it is unclear whether there might be any changes to a goods-on-the-water policy. Given this lack of clarity, it is likely that US buyers will continue to sit tight until 9 July, when a further decision can be expected.

Fine wine monitor – in association with

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at:

www.liv-ex.com

Following President Trump’s tariff announcement on 2 April, Liv-ex anticipated three possible phases: US greatly reduces buying for a period; the reduction in demand prompts a further fall in prices; US buyers come back when stock is required.

As expected, US buying and, subsequently, prices fell sharply during April.

Following President Trump’s tariff announcement on 2 April, Liv-ex anticipated three possible phases: US greatly reduces buying for a period; the reduction in demand prompts a further fall in prices; US buyers come back when stock is required.

As expected, US buying and, subsequently, prices fell sharply during April.