Ubisoft Sees 20% Booking Drop and Stock Dip as ‘Assassin’s Creed: Shadows’ Fails To Boost Full-Year Sales

Ubisoft's fortunes fail to improve despite its best efforts, although a partnership with Tencent could improve its fortunes.

Embattled game publisher Ubisoft delivered its full-year 2024-2025 earnings report on May 14, one that did little to assuage the concerns of investors, as CNBC reported.

Despite the relative strength and success of sales driven by its latest AAA title release, “Assassins Creed: Shadows,” in late March, Ubisoft nonetheless outlined a 20.5% tumble in net bookings for the FY ending March 31, 2025, with that metric signifying the value of potential revenue in the near future.

International Financial Reporting Standards (IFRS) net income also showed in the red, with Ubisoft reporting a $92.3 million loss in this regard (or about $17 million on a non-IRFS basis), per the company’s official earnings report.

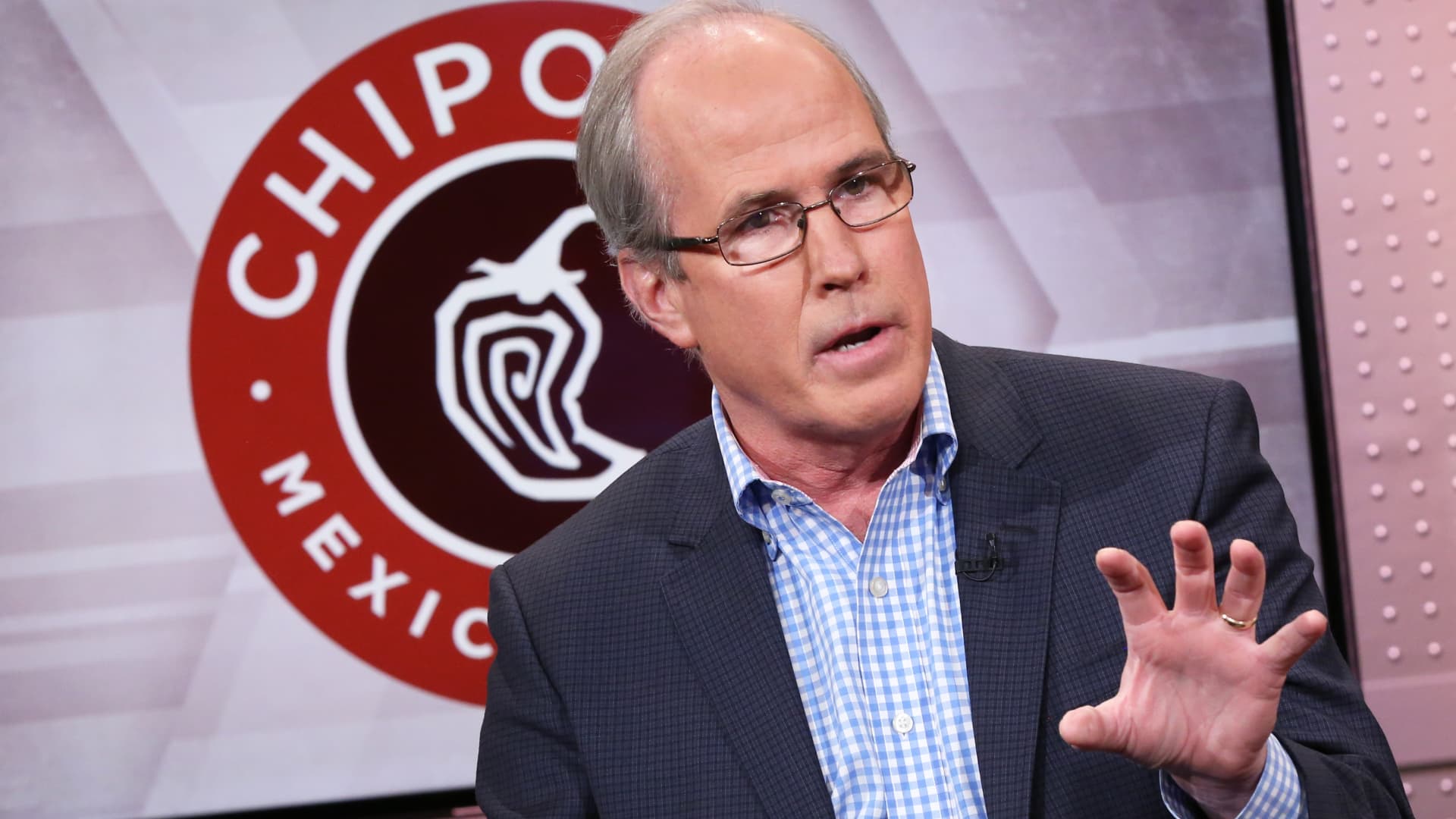

In remarks attached to the earnings report, Ubisoft co-founder and CEO Yves Guillemot added a silver lining to the results.

“This year has been a challenging one for Ubisoft, with mixed dynamics across our portfolio, amid intense industry competition. Despite these headwinds, Ubisoft managed to deliver positive free cash flow generation over the fiscal year, reflecting the discipline applied across the Group,” Guillemot said before reiterating the appeal and continued strength of its flagship Assassin’s Creed intellectual property.

“We also completed our initial cost savings program ahead of schedule. We are committed to going further, with additional savings of at least €100m [~$112 million] over the next two years to drive structural efficiencies and reinforce the foundations of our organization,” he added.

Ubisoft Endures Another Stock Price Plunge Following FY 2024-2025 Earnings, Sparse Releases Over the Next Year

Contributing to a nearly 60% plunge in its stock price over the course of the past six months, as of 12:17 p.m. ET, Ubisoft’s share price had shed about 18% in value during the day’s trading, signaling investor fears about the company’s ability to generate profit in the days to come.

This comes despite dueling reports that Ubisoft will both be delaying releases of some upcoming projects in order to allow for the best odds of market success — leading to a rather sparse release schedule for the next 12 months, as Rock Paper Shotgun reported — and of the creation of a new subsidiary backed by fellow gaming giant Tencent, a Chinese multinational.

CNBC detailed the latter news, with Tencent slated to invest $1.3 billion into the planned subsidiary, affording it a 25% stake. IPs such as Assassin’s Creed, Far Cry, and Tom Clancy’s Rainbow Six are projected for development by said subsidiary, and Ubisoft would retain majority interest, taking in royalties related to said ownership of the aforementioned properties.

That deal is set to finalize as 2025 draws to a close.