Transportation rates likely to surge during tariff pause

The 90-day tariff pause is likely to provide a bump to transportation rates as shippers take advantage of the new window. The post Transportation rates likely to surge during tariff pause appeared first on FreightWaves.

U.S. and Chinese officials have reached an agreement to roll back most recent tariffs and implement a 90-day truce in their trade war to facilitate further negotiations. Announced in Geneva, this deal marks a significant step back from a conflict that has disrupted the global economy. The temporary suspension of hostilities is expected to have immediate effects on global shipping and transportation markets.

Current Freight Rate Forecast

Freight rates are projected to rise sharply in the coming weeks as importers rush to capitalize on this window of opportunity. The increases are expected to begin with ocean freight rates in the near term, followed by domestic trucking rates in July and August. This surge stems from importers addressing existing backlogs and expediting new orders before potential policy changes at the end of the 90-day period.

This pattern echoes transportation capacity challenges observed in late 2021 and early 2022, as carriers seek to maximize pricing power during an anticipated surge in shipments.

Implications of the Tariff Suspension

This abrupt shift in trade policy is likely to create significant logistical challenges. Companies may struggle to secure containers in China and access truck or intermodal chassis capacity in the United States. Transportation capacity and infrastructure could be strained by the surge in shipping volume.

Larger, more consistent importers are likely to benefit most, as they typically receive preferential treatment from carriers when capacity tightens. Smaller shippers may face disadvantages, as transportation providers prioritize high-value customers and sideline inconsistent or lower-paying shippers.

Details of the 90-Day Truce

Under the agreement, the United States will reduce its tariff rate on Chinese goods from 145% to 30%, while China will lower its rate on U.S. goods from 125% to 10%. This represents a 115 percentage point reduction for the U.S. and a 105 percentage point reduction for China as part of the temporary truce.

U.S. Treasury Secretary Scott Bessent emphasized that neither country seeks economic decoupling. “The consensus from both delegations this weekend is that neither side wants a decoupling,” Bessent said. “What had occurred with these very high tariffs was effectively an embargo. Neither side wants that. We want trade.”

China’s Commerce Ministry described the agreement as “an important step toward resolving the two countries’ differences” and “laying the foundation for further cooperation.” The ministry noted that the initiative “aligns with the expectations of producers and consumers in both countries and serves the interests of both nations as well as the global community.”

Impact on the Global Economy

Financial markets reacted positively to the news, with stock futures rising sharply. S&P 500 futures climbed 2.6%, and Dow Jones Industrial Average futures also increased. Oil prices surged by more than $1.60 per barrel, and the U.S. dollar strengthened against the euro and Japanese yen.

The de-escalation of tensions between the world’s two largest economies has provided immediate relief to global markets, which had been bracing for the effects of what would have amounted to mutual trade embargoes. The potential disruption would have been significant, with combined trade exceeding $660 billion last year.

Take Action to Prepare

Transportation rates are expected to surge as importers rush to leverage the temporary tariff reductions, potentially creating capacity constraints across the supply chain. A backlog of unshipped orders from prior weeks, combined with an influx of new orders, will likely strain logistics networks as importers prepare for potential future disruptions.

Companies should ship as early as possible to minimize delays and reduce the risk of cargo being bumped during this period of heightened activity. Those who act quickly will be best positioned to navigate the anticipated transportation challenges and freight rate increases in the coming months.

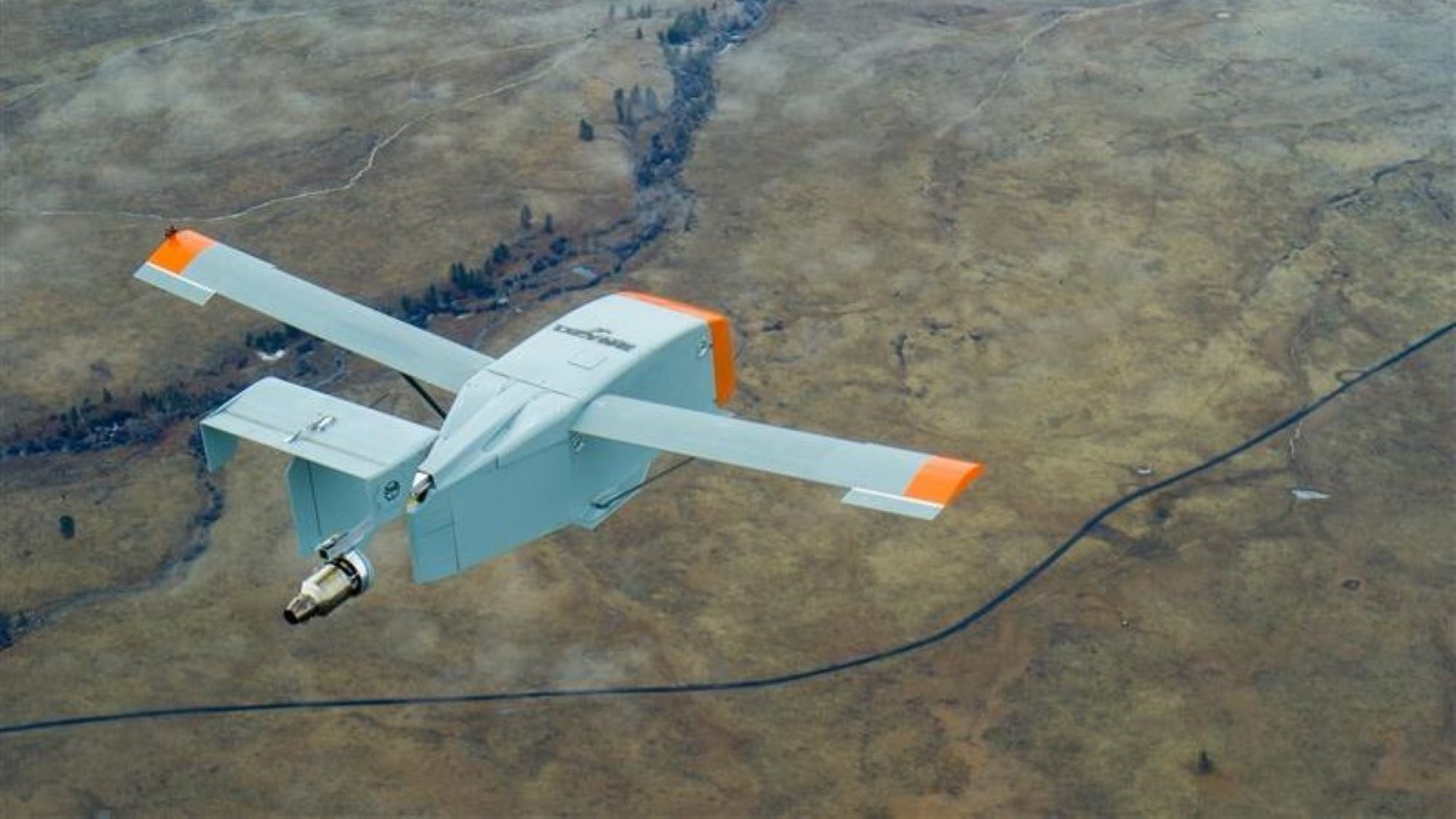

Capacity and rate changes are expected to escalate rapidly. Shippers can mitigate disruptions and avoid being caught off guard by surging rates using SONAR’s high-frequency freight data. SONAR publishes over 4 million real-time data points tracking global freight demand, capacity, and rates.

The post Transportation rates likely to surge during tariff pause appeared first on FreightWaves.

.jpeg)