THG rejects ‘undervalued’ £400m+ offer for Myprotein

THG has rejected an unsolicited takeover bid from Selkirk, the investment vehicle led by former director Iain McDonald, for its Myprotein brand,

THG has rejected an unsolicited takeover bid from Selkirk, the investment vehicle led by former director Iain McDonald, for its Myprotein brand, calling the offer “wholly unsolicited, largely unfunded, highly conditional, and non-binding.”

The offer, which valued Myprotein at between £400m and £600mon a cash-free, debt-free basis, was primarily structured through newly issued shares from Selkirk.

In a statement to the stock market this morning (23 April 2024) THG also revealed that the remainder of the consideration would have been payable in cash from a new equity and debt issuance, which was largely unfunded and without appropriate detail on its source.

“The Board considered that the Proposal fundamentally undervalued Myprotein and its prospects, and in addition carried significant execution complexity and risks, in particular the ability of Selkirk to raise sufficient funding. On this basis, the Proposal was unequivocally rejected by the Board. THG confirms that there has been no further engagement with Selkirk since the Proposal was rejected.”

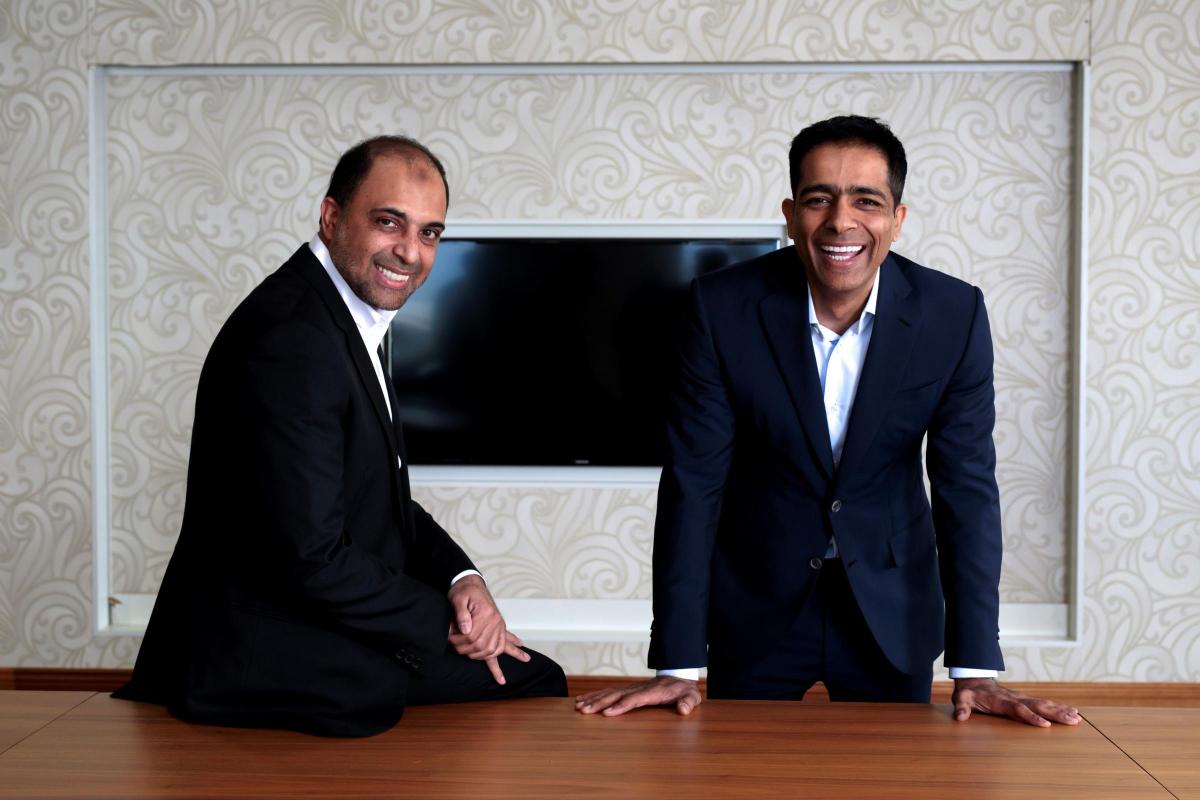

Selkirk was established as a cash shell in October 2024 by Iain McDonald, former THG director who left the company after 14 years with plans to acquire “an undervalued company or business in the UK” within the consumer, technology, and digital media sectors.

The firm raised £7.5m in capital, with 18% of the funds coming from McDonald’s Belerion Capital, while activist investor Kelso Group, a long-time critic of THG, also backed the initiative.

Click here to sign up to Retail Gazette‘s free daily email newsletter