Supply Chain and Logistics News April 28th to May 1st 2025

In a week marked by major shifts in global industry and policy, MISUMI’s $350 million acquisition of AI-driven supply chain platform Fictiv signals a bold move to integrate smart manufacturing at scale. Meanwhile, the U.S. deepened its strategic partnership with Ukraine through a landmark mineral access and reinvestment deal aimed at bolstering both nations’ economic […] The post Supply Chain and Logistics News April 28th to May 1st 2025 appeared first on Logistics Viewpoints.

In a week marked by major shifts in global industry and policy, MISUMI’s $350 million acquisition of AI-driven supply chain platform Fictiv signals a bold move to integrate smart manufacturing at scale. Meanwhile, the U.S. deepened its strategic partnership with Ukraine through a landmark mineral access and reinvestment deal aimed at bolstering both nations’ economic and geopolitical stability. The auto industry continues to reel from tariff pressures, facing costs of up to $12,000 per vehicle despite regulatory reprieve. At the Infor Analyst Innovation Summit, the spotlight was on AI, automation, and ESG as pillars of future-ready cloud solutions. Simultaneously, UPS announced a sweeping reconfiguration plan—cutting 20,000 jobs and shuttering 73 facilities—as it distances itself from unprofitable Amazon outbound volume, underscoring the logistics sector’s evolving priorities.

In a week marked by major shifts in global industry and policy, MISUMI’s $350 million acquisition of AI-driven supply chain platform Fictiv signals a bold move to integrate smart manufacturing at scale. Meanwhile, the U.S. deepened its strategic partnership with Ukraine through a landmark mineral access and reinvestment deal aimed at bolstering both nations’ economic and geopolitical stability. The auto industry continues to reel from tariff pressures, facing costs of up to $12,000 per vehicle despite regulatory reprieve. At the Infor Analyst Innovation Summit, the spotlight was on AI, automation, and ESG as pillars of future-ready cloud solutions. Simultaneously, UPS announced a sweeping reconfiguration plan—cutting 20,000 jobs and shuttering 73 facilities—as it distances itself from unprofitable Amazon outbound volume, underscoring the logistics sector’s evolving priorities.

Top Supply Chain and Logistics News From This Week:

AI Leader in Global Supply Chain & Manufacturing joins MISUMI

Fictiv, a global supply chain technology company, has announced its acquisition by MISUMI Group Inc., a leading supplier of mechanical components for the manufacturing industry, in an all-cash transaction valued at $350 million. This acquisition aims to enhance manufacturing and supply chain solutions by integrating AI-driven technology with robust physical infrastructure. Fictiv’s AI-powered workflows and global manufacturing network simplify sourcing for custom mechanical components, having produced over 35 million parts for various industries. MISUMI’s extensive customer base and quality conformance will further bolster Fictiv’s capabilities, offering a scalable, efficient platform for building products.

Fictiv, a global supply chain technology company, has announced its acquisition by MISUMI Group Inc., a leading supplier of mechanical components for the manufacturing industry, in an all-cash transaction valued at $350 million. This acquisition aims to enhance manufacturing and supply chain solutions by integrating AI-driven technology with robust physical infrastructure. Fictiv’s AI-powered workflows and global manufacturing network simplify sourcing for custom mechanical components, having produced over 35 million parts for various industries. MISUMI’s extensive customer base and quality conformance will further bolster Fictiv’s capabilities, offering a scalable, efficient platform for building products.

US and Ukraine Sign Long-Sought Mineral Deal

The U.S. and Ukraine have signed a significant economic deal granting Washington access to Ukraine’s critical minerals and other natural resources. This agreement, known as the United States-Ukraine Reinvestment Fund, aims to secure long-term American support for Ukraine’s defense against Russia. The deal includes rare earth elements, oil, and natural gas, with profits from new investments being reinvested into Ukraine’s reconstruction. The fund will be managed equally by both countries and supported by the U.S. International Development Finance Corporation. Ukrainian officials emphasize that the agreement ensures full ownership of resources remains with Ukraine and does not impose debt obligations. It does not include resources that are already a source of revenue for the Ukrainian state. In other words, any profits under the deal are dependent on the success of new investments. This strategic move is seen as a way to maintain U.S. military support and signal a commitment to Ukraine’s sovereignty and prosperity.

The U.S. and Ukraine have signed a significant economic deal granting Washington access to Ukraine’s critical minerals and other natural resources. This agreement, known as the United States-Ukraine Reinvestment Fund, aims to secure long-term American support for Ukraine’s defense against Russia. The deal includes rare earth elements, oil, and natural gas, with profits from new investments being reinvested into Ukraine’s reconstruction. The fund will be managed equally by both countries and supported by the U.S. International Development Finance Corporation. Ukrainian officials emphasize that the agreement ensures full ownership of resources remains with Ukraine and does not impose debt obligations. It does not include resources that are already a source of revenue for the Ukrainian state. In other words, any profits under the deal are dependent on the success of new investments. This strategic move is seen as a way to maintain U.S. military support and signal a commitment to Ukraine’s sovereignty and prosperity.

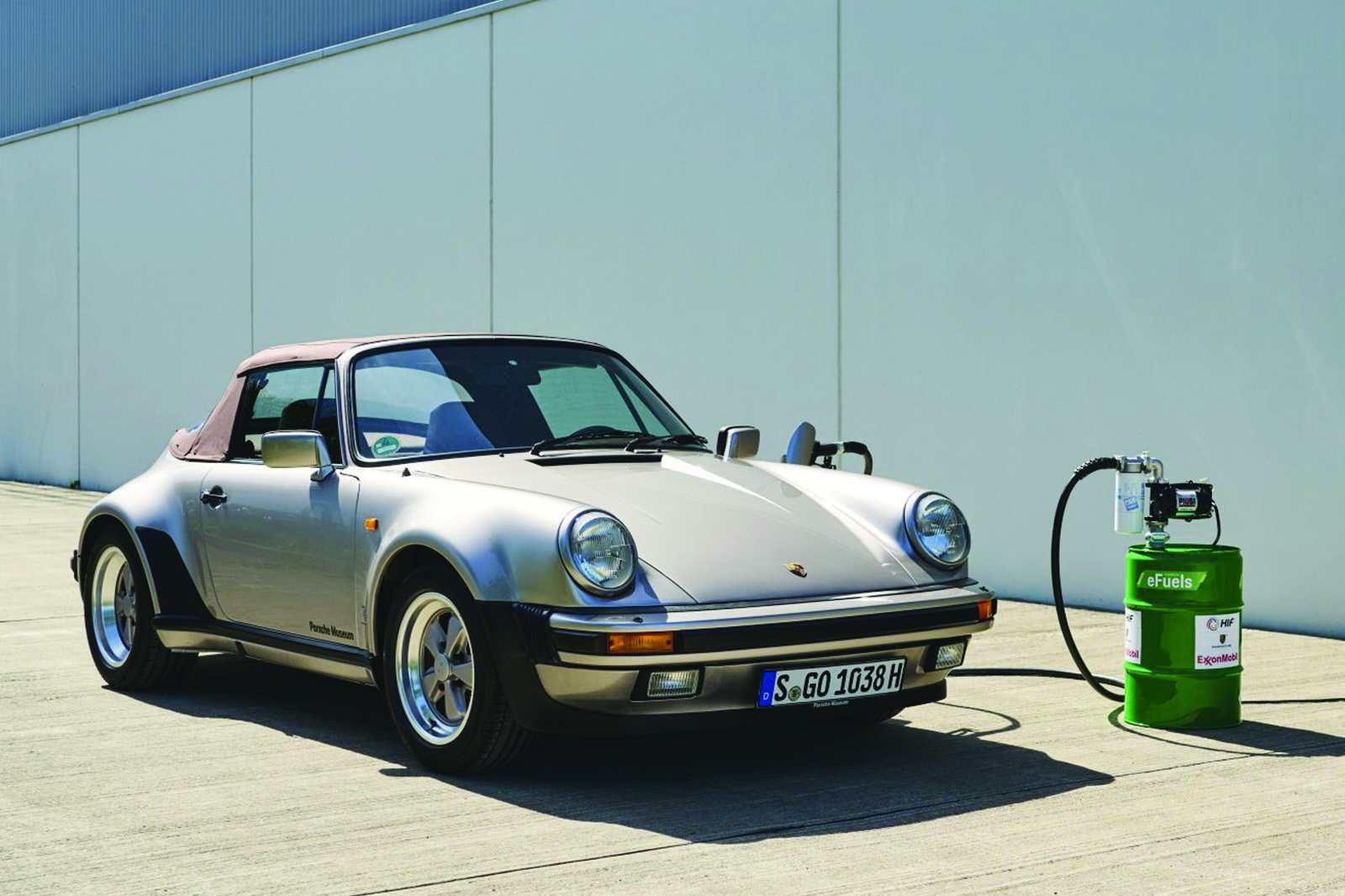

Automakers Still Face up to $12,000 Impact Per Car from Tariffs

U.S. automakers may still face a $2,000 to $12,000 tariff impact per vehicle despite the White House moving to soften trade levies on imported auto parts. U.S.-assembled vehicles like Honda’s Civic and Odyssey, the Chevy Malibu, Toyota Camry Hybrid, and Ford Explorer faced an impact of $2,000 to $3,000. These same tariffs could impact imported vehicles with an added $10,000 to $12,000, including full-size luxury SUVs, some EVs, and other vehicles assembled in Europe and Asia, such as the Mercedes G-Wagon, Land Rover, and Range Rover models, some BMW models, and the Ford Mach-E. GM announced this week that it expected a hit from tariffs up to $5 billion, including $ 2 billion on vehicles it imports from South Korea. Earlier this week, Trump agreed to give carmakers two years to boost the percentage of domestic components in vehicles assembled in the United States.

U.S. automakers may still face a $2,000 to $12,000 tariff impact per vehicle despite the White House moving to soften trade levies on imported auto parts. U.S.-assembled vehicles like Honda’s Civic and Odyssey, the Chevy Malibu, Toyota Camry Hybrid, and Ford Explorer faced an impact of $2,000 to $3,000. These same tariffs could impact imported vehicles with an added $10,000 to $12,000, including full-size luxury SUVs, some EVs, and other vehicles assembled in Europe and Asia, such as the Mercedes G-Wagon, Land Rover, and Range Rover models, some BMW models, and the Ford Mach-E. GM announced this week that it expected a hit from tariffs up to $5 billion, including $ 2 billion on vehicles it imports from South Korea. Earlier this week, Trump agreed to give carmakers two years to boost the percentage of domestic components in vehicles assembled in the United States.

Infor Analyst Innovation Summit 2025: A Look at the Future of Industry Cloud

The Infor Analyst Innovation Summit 2025 in Manhattan showcased Infor’s strategic vision for the future, emphasizing its role as an “Industry Cloud Complete Company.” Key highlights included their focus on addressing the “Value Void” in digital transformation projects, and their three innovation pillars: Diagnose (using Infor Process Mining), Automate (leveraging RPA, IDP, and iPaaS), and Optimize (driven by Infor AI). The summit also highlighted Infor Nexus’s efforts to tackle supply chain disruptions through ESG & Traceability, Intelligence & AI Transformation, and the integration of Generative AI. Overall, the event underscored Infor’s commitment to delivering industry-specific solutions and accelerating innovation to ensure customer success.

The Infor Analyst Innovation Summit 2025 in Manhattan showcased Infor’s strategic vision for the future, emphasizing its role as an “Industry Cloud Complete Company.” Key highlights included their focus on addressing the “Value Void” in digital transformation projects, and their three innovation pillars: Diagnose (using Infor Process Mining), Automate (leveraging RPA, IDP, and iPaaS), and Optimize (driven by Infor AI). The summit also highlighted Infor Nexus’s efforts to tackle supply chain disruptions through ESG & Traceability, Intelligence & AI Transformation, and the integration of Generative AI. Overall, the event underscored Infor’s commitment to delivering industry-specific solutions and accelerating innovation to ensure customer success.

UPS Plans 20k Jobs Cuts This Year As Amazon Pullback Advances

UPS plans to cut roughly 20,000 positions throughout its U.S. network in 2025 as the carrier moves forward with its plan to slash its Amazon volume by half, according to a Q1 earnings release Tuesday. The carrier also plans to close 73 facilities by the end of June due to the ongoing Amazon volume reduction, but did not specify which locations would shut down. UPS is using lessons learned from its closure of 11 buildings in 2024 as a “blueprint” for the initiative, CEO Carol Tomé said on an earnings call following the announcement. The shakeup, which UPS referred to as its “Network Reconfiguration,” is an expansion of the company’s Network of the Future initiative, which is consolidating its operational footprint. UPS expects to realize $3.5 billion in cost savings from the efforts in 2025, about $500 million of which came in Q1, CFO Brian Dykes said on the call. The volume reduction targets outbound shipments from Amazon’s fulfillment centers, a delivery type that “is not profitable for us, nor a healthy fit for our network,” Tomé said. The company is keeping more profitable returns volume and outbound shipments fulfilled by sellers, she added.

UPS plans to cut roughly 20,000 positions throughout its U.S. network in 2025 as the carrier moves forward with its plan to slash its Amazon volume by half, according to a Q1 earnings release Tuesday. The carrier also plans to close 73 facilities by the end of June due to the ongoing Amazon volume reduction, but did not specify which locations would shut down. UPS is using lessons learned from its closure of 11 buildings in 2024 as a “blueprint” for the initiative, CEO Carol Tomé said on an earnings call following the announcement. The shakeup, which UPS referred to as its “Network Reconfiguration,” is an expansion of the company’s Network of the Future initiative, which is consolidating its operational footprint. UPS expects to realize $3.5 billion in cost savings from the efforts in 2025, about $500 million of which came in Q1, CFO Brian Dykes said on the call. The volume reduction targets outbound shipments from Amazon’s fulfillment centers, a delivery type that “is not profitable for us, nor a healthy fit for our network,” Tomé said. The company is keeping more profitable returns volume and outbound shipments fulfilled by sellers, she added.

Song of the week:

The post Supply Chain and Logistics News April 28th to May 1st 2025 appeared first on Logistics Viewpoints.