Shifting Gears: New Rules, New Rivals and the Road Ahead

Independent Contractor Fight Reignites — DOL Backs Off Biden-Era Rule for Now The U.S. Department of Labor just announced a major shift: It’s officially putting the brakes on enforcing the 2024 Biden-era independent contractor rule — at least for now. In a memo sent May 1 by acting Wage and Hour Administrator Donald Harrison III, […] The post Shifting Gears: New Rules, New Rivals and the Road Ahead appeared first on FreightWaves.

Independent Contractor Fight Reignites — DOL Backs Off Biden-Era Rule for Now

The U.S. Department of Labor just announced a major shift: It’s officially putting the brakes on enforcing the 2024 Biden-era independent contractor rule — at least for now.

In a memo sent May 1 by acting Wage and Hour Administrator Donald Harrison III, the department confirmed that it will stop applying the controversial 2024 rule while court challenges play out. Instead, field investigators will fall back on older guidance from 2008 — a move widely seen as more favorable to independent contractors and owner-operators.

“The Department has taken the position in those lawsuits that it is reconsidering the 2024 rule, including whether to rescind the regulation,” Harrison wrote.

The move gives trucking and other industries some breathing room — at least temporarily — as the legal system weighs in.

How We Got Here:

The 2024 rule, adopted earlier this year, attempted to redefine how workers are classified under the Fair Labor Standards Act. It replaced Trump-era guidelines that emphasized a simpler, two-factor test, and instead introduced a more complex six-factor “economic realities” framework:

- Opportunity for profit or loss depending on managerial skill.

- Investments made by the worker versus employer.

- Permanence of the working relationship.

- Nature and degree of control.

- Whether the work is integral to the employer’s business.

- Skill and initiative of the worker.

Trucking groups, including the American Trucking Associations, fought hard against the new rule, arguing it would undermine the traditional owner-operator model that the industry depends on.

Industry Response:

American Trucking Associations President Chris Spear called the department’s pause a major step in the right direction.

“This is a crucial first step toward returning to the common-sense standard set forth during the Trump administration, which protected the freedom of individuals to choose work arrangements that best suit their needs,” Spear said. “The trucking industry has relied on independent contractors since the very beginning of interstate trucking.”

Spear also reaffirmed ATA’s commitment to advocating for the 350,000 independent truckers nationwide who depend on contractor status for economic opportunity and flexibility.

What Happens Next:

Until the court challenges are resolved, investigators will rely on a 2008 fact sheet to guide worker classification decisions. The document favors a broader definition of independent work compared to the 2024 rule.

Greg Feary, president of the trucking law firm Scopelitis, Garvin, Light, Hanson & Feary, said the department’s shift is significant — but temporary.

“They don’t want to use the Biden rule right now,” Feary explained. “So they told the field investigators: Just use the 2008 guidance and apply the economic realities test. It’s going to be more favorable than the Biden rule — but not quite as favorable as the Trump rule.”

Looking ahead, many in the industry expect that if the political winds shift again, a return to the 2021 Trump-era approach — focusing heavily on just two main factors (control and opportunity for profit/loss) — could resurface.

Bottom Line for Small Carriers

For now, independent contractors can breathe a little easier. But don’t mistake this for the end of the battle.

The status of owner-operators remains a moving target — and fleets depending on contractors need to stay sharp, compliant and ready to pivot if the legal landscape changes again.

This fight isn’t over. It’s just in extra innings.

China Agrees to Trade Talks — But the Tariff Damage Is Already Done

The U.S. and China are heading back to the negotiation table — but the economic bruises from the tariff war are already starting to show.

On Tuesday, both sides confirmed they’ll meet later this week in Geneva for high-level trade discussions between U.S. Treasury Secretary Scott Bessent, U.S. Trade Representative Jamieson Greer and Chinese Vice Premier He Lifeng. The talks come at the direct request of the U.S. side — a rare signal of urgency as pressure mounts on both economies.

But don’t get too excited yet.

Despite the meeting, neither side is showing signs of backing off. China’s Foreign Ministry has made it clear: “Any form of pressure or coercion against China will not work.”

Translation: Expect a long, slow drag.

Why It Matters Right Now:

Tariffs imposed by the U.S. — reaching as high as 145% on Chinese imports — are already dragging down China’s export-driven economy, hitting it at a vulnerable time. In return, China slapped up to 125% tariffs on U.S. goods and drastically cut back on purchasing American agricultural products.

China’s response this week was aggressive:

- Cutting the central bank’s reverse repo rate from 1.5% to 1.4%.

- Slashing commercial bank lending rates.

- Reducing reserve requirements to free up $137.6 billion (1 trillion yuan) in liquidity.

- Lowering interest rates on five-year housing loans.

This is a full-blown stimulus move designed to soften the blow and prop up factories, exporters and service sectors.

But make no mistake — this is damage control, not victory laps.

The Freight Connection: How This Hits Small Carriers

All of this tariff noise isn’t just happening overseas. It’s bleeding straight into the American trucking market.

- Reduced Imports = Less Freight: Port volumes, especially on the West Coast, are under pressure because fewer goods are moving from China into the U.S. — fewer containers means fewer transload opportunities, less dry van freight and more spot market competition.

- Weaker Consumer Goods Flow: A slowdown in Chinese imports means fewer electronics, appliances, machinery and textiles — all staples of dry van and flatbed freight. That softer inbound volume ripples inland fast.

- Prolonged Uncertainty: For small carriers already battling low spot rates and tighter capacity, prolonged tariff battles mean no fast recovery. Any lift in volume will be slow and sporadic, not sudden.

As we’ve been saying for months:

Small fleets have to stay nimble, aware and relationship-driven in this environment.

Waiting on a port freight surge or a magical tariff rollback is like waiting for rain in the desert.

What to Watch This Week:

- Whether the Geneva talks produce any sign of tariff relief or road map to easing duties.

- If China’s stimulus injection actually stabilizes factory output — or if weakening consumer demand still drags it down.

- How U.S. spot market volumes react through May, especially in van and intermodal.

Bottom Line

Negotiations are happening, but there’s no handshake deal in sight. The freight market is already feeling the squeeze. And for small carriers?

Adapting to the reality you see — not the deal you hope for — is the only way to survive this cycle.

Understanding Today’s Tender Rejections and Volumes: What It Means for Small Carriers

When we talk about tender rejections, we’re talking about how often a carrier says “No thanks” to a load offered to them under a contract rate. Typically, carriers reject tenders when the spot market is paying better, giving them a reason to chase higher-paying freight instead of sticking to contract work.

Right now, according to the SONAR Van Outbound Tender Rejection Index (VOTRI.USA), we’re sitting at just 4.49%.

Here’s what that means in plain terms:

Only about 1 out of every 20 contracted loads is getting turned down today.

If you look back at the historical chart, this 4.49% rejection rate is way low compared to past peaks. In 2024, rejection rates popped up to over 8.5% during the summer months. And even in smaller surges, like late fall 2024, rejections hovered around 7% for a bit.

Translation? Carriers don’t have many better-paying options floating around right now, and those that have contracted freight are hanging on to it tighter than ever. That’s a signal that the spot market is still weak. If the spot market were booming, you’d see those rejections spiking again because carriers would be chasing the better rates.

Now let’s pair that up with volume.

The Van Outbound Tender Volume Index (VOTVI.USA) shows the total number of contracted loads getting tendered across the country. Right now, volume sits at 7,123.

Volume tells us: Is there even enough freight moving around? And here’s the story: Compared to last year at this time, we’re lower.

In 2024 around early May, we were up around 7,800-plus, and even higher as the summer shipping season kicked in. Today we’re bouncing around the low 7,000s. That might not seem like a huge drop on paper, but for small carriers that live load to load, it’s a real grind.

Lower tender volume + low rejection rates = contracts are “king” right now, and if you’re relying heavily on spot market freight, you’re feeling the pinch.

Key takeaway for small carriers:

- If you have steady direct freight or locked-in contracts, protect those relationships at all costs right now.

- If you’re depending on the spot market, it’s still a tight game — rates aren’t spiking and freight isn’t growing yet.

- Planning is critical: Load density matters more than ever. Go where the freight is. Don’t just sit waiting on it to come to you.

The good news? Historically, summer tends to bring a small bump in both volume and spot opportunities. But it won’t be a flood — it’ll be a scrappy fight to win better freight.

Diesel Prices Cooling Off — But Stay Alert

If you’re a small carrier trying to plan your costs, here’s some good news — diesel prices are trending down over the past month.

According to the Department of Energy’s latest data, the U.S. average diesel price as of Monday sits at $3.497 per gallon, a noticeable drop compared to early April when we were paying around $3.639.

Let’s break that down by region:

- East Coast: $3.567.

- Midwest: $3.432.

- Gulf Coast (cheapest): $3.174.

- West Coast (most expensive): $4.204.

- California (always its own story): $4.728.

Compared to just a month ago, these numbers reflect roughly a 10-to-15-cent-per-gallon dip across most areas. It might not feel like a lot at the pump on one fill-up, but over the course of a month running regional or long-haul? That’s real money staying in your pocket.

Here’s Why This Matters:

For small carriers especially, diesel is usually your second-largest operating expense right after driver pay. When diesel moves even 10 cents per gallon, your cost per mile shifts — and if you aren’t adjusting your rate floors or fuel surcharges accordingly, you’re eating that cost.

Quick Real-World Example:

- If you run 2,500 miles a week …

- And you’re saving 10 cents per gallon over 6 miles per gallon …

- You’re pocketing an extra $41 a week, or around $164 a month.

Not game-changing by itself — but when margins are tight, every bit matters.

Keep This In Mind:

- Fuel prices tend to stay cooler through May into June unless a major hurricane or refinery event spikes costs.

- Monitor regional prices, not just national averages. (Example: Midwest versus West Coast is nearly an 80-cent swing right now!)

- Always have a basic breakeven number you watch week to week so you know exactly how much rate you must have.

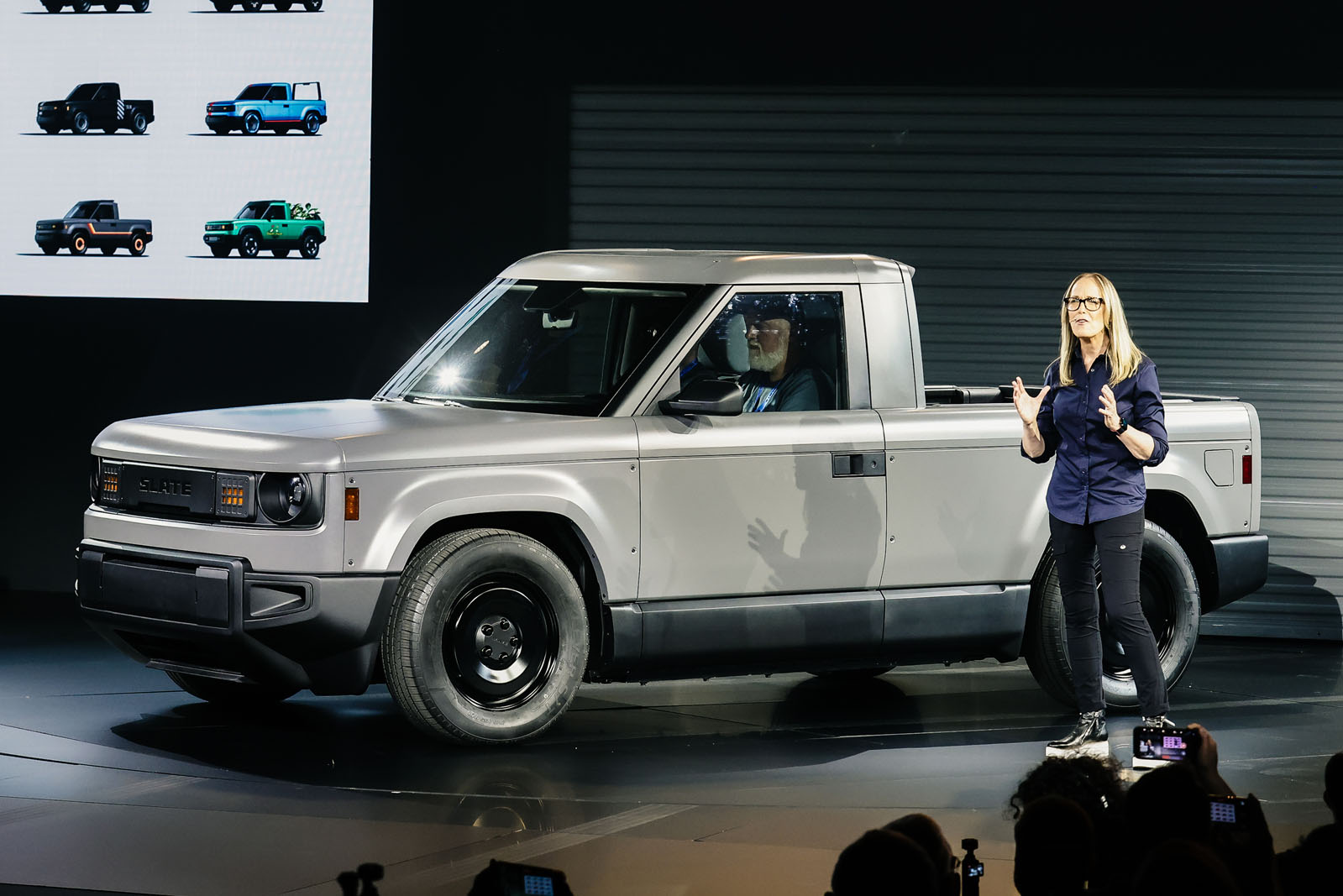

Peterbilt Steps Boldly Into the EV Ring — Meet the New 579EV and 567EV

While all the noise lately has been about Tesla and its Semi truck, another heavyweight has officially entered the electric arena — and this one’s a familiar face: Peterbilt.

Peterbilt, one of the most respected names in heavy-duty trucking, just unveiled two new battery-electric models — the next-generation 579EV and the all-new 567EV. And if you’re thinking this is just another “concept truck” or a marketing play, think again. Peterbilt spent the past five years field-testing real-world electric trucks, gathering data and putting that knowledge right back into these new designs.

Both trucks are built around Paccar’s new ePowertrain system, offering fleets flexibility with multiple battery configurations, power ratings up to 605 horsepower and a maximum range of up to 250 miles — all while trying to mimic the performance and feel of traditional diesel trucks.

Here’s the quick breakdown:

- Model 579EV: Aimed at regional haul and drayage operations. Designed to feel just like the diesel 579 but powered entirely by batteries. Available with 250kWh, 375kWh or 500kWh battery packs.

- Model 567EV: Peterbilt’s first crack at a vocational electric truck — built tough for dump trucks, utility fleets, equipment haulers and more. Four battery pack options here, maxing out at 625kWh and 250 miles of range.

Both trucks feature midship-mounted dual electric motors, a three-speed transmission (to keep torque smooth and strong) and fast-charging capabilities — 80% charge in about 90 minutes with 350kW DC fast chargers.

Why This Matters:

Peterbilt is showing that EVs in trucking are moving beyond “cool new tech” into real operational options. And unlike newer entrants, the company understands what fleets demand: trucks that work, that fit into existing operations and that don’t force drivers to relearn everything.

The trucks were designed with familiar ergonomics, regenerative braking options, industry-standard body hookups and SmartDisplay tech in the cab for easy management. They even have EV-specific styling tweaks — but at the end of the day, the trucks still feel like trucks.

The Big Picture:

Electric heavy-duty trucks aren’t a gimmick anymore. Tesla might have made the first splash, but Peterbilt (and other major players) are getting serious, especially for fleets operating in states like California, where zero-emission mandates are becoming real deadlines, not just suggestions.

If you’re running regional routes, local deliveries or vocational operations where trucks return to home base every night for charging — these trucks are starting to make more sense.

And more importantly, a name like Peterbilt getting behind it means infrastructure, service, parts and dealer support are finally catching up to the technology.

Bottom Line:

Electric trucks aren’t coming someday. They’re here. And trusted brands are making sure they’re built for the real world — not just headlines.

Final Word: The Only Constant Is Change

Every week in this business, it feels like the ground moves just a little more.

This week proved it again — with the Labor Department pulling back on independent contractor rules, China and the U.S. stepping back to the negotiating table, tender rejections slipping again, and even Peterbilt stepping into the EV fight with serious firepower.

If you’re a small carrier, this isn’t the time to sit still. It’s time to learn faster, move smarter and build stronger.

The winners won’t just be the biggest fleets with the most money — they’ll be the carriers that stay alert, read the market for what it really is (not what they wish it was) and pivot without fear when opportunity calls.

Every mile you drive and every load you haul is part of your story. Make sure it’s a story you’re proud to tell when the dust settles.

Keep your hands on the wheel. Eyes on the road. And your business moving forward.

Until next time — stay sharp and stay rolling.

The post Shifting Gears: New Rules, New Rivals and the Road Ahead appeared first on FreightWaves.