Army secretary says it will be ‘success’ if prime contactor dies on his watch

“My best guess is that they will start to realize in the coming days, weeks and months, that they are going to have to adapt and change or die. We are not going to come to bail them out again as a nation,” said Army Secretary Daniel Driscoll.

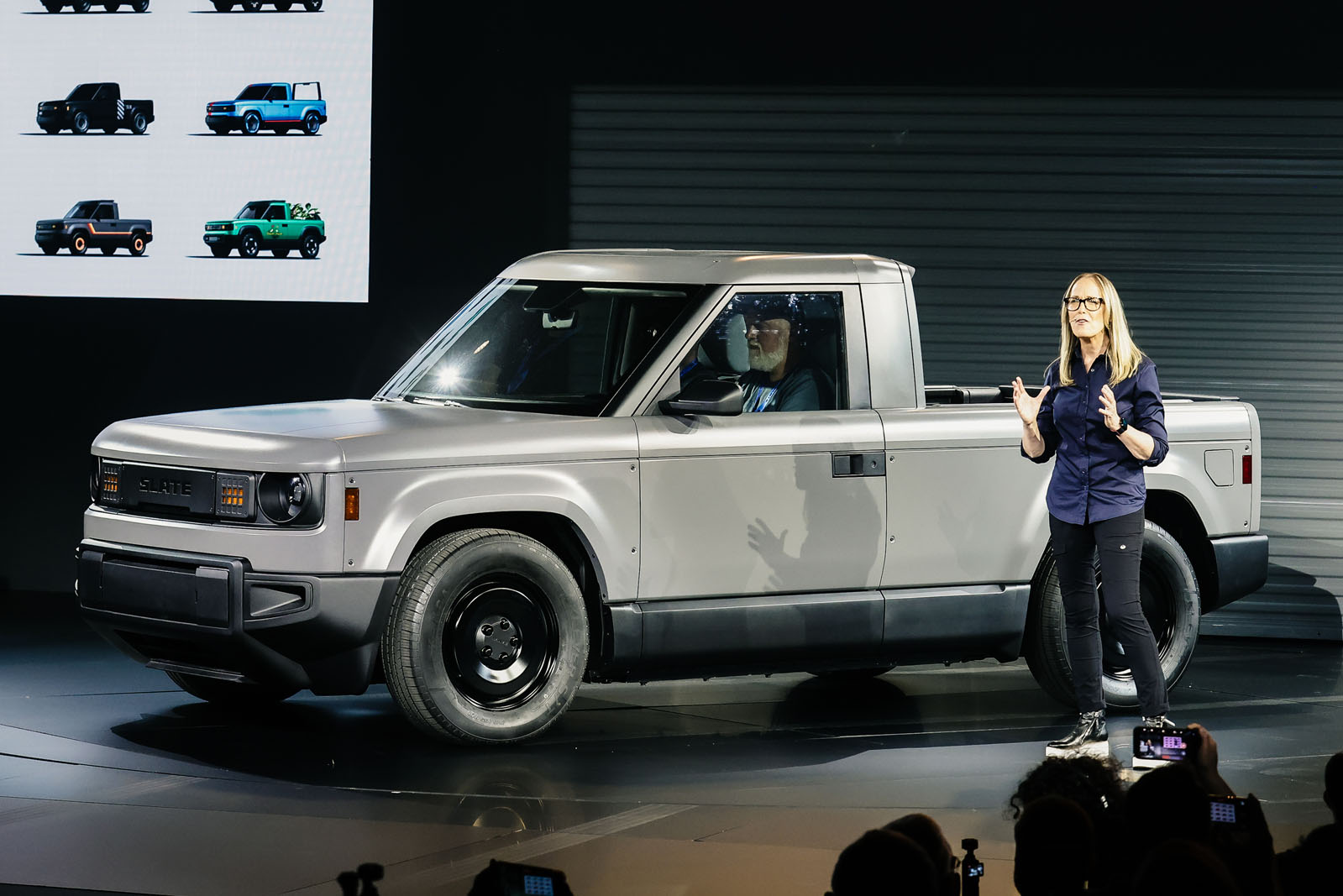

Army Secretary Dan Driscoll flies in a UH-60 Blackhawk at Fort Irwin March 13, 2025. (US Army/ Sgt. 1st Class Nicole Mejia)

WASHINGTON — Army Secretary Daniel Driscoll hasn’t masked his desire to shake up the defense sector but he upped the ante this week, calling it a “success” if a large prime contractor closes its doors in the coming years if they can’t start operating more efficiently.

“I will measure it as success if in the next two years, one of the primes is no longer in business, and the rest of them have all gotten stronger,” he said Thursday on the TBPN podcast.

Driscoll’s comments reflect the Trump administration’s ongoing embrace of the venture capital and tech industries, including VC-backed startups like Anduril, Palantir and others who have begun to take root as major players in the defense industrial base. (Anduril has already taken over one big-ticket Army contract, the Integrated Visual Augmentation System.)

Driscoll, like other key Pentagon appointees, hails from the private equity and venture capital worlds, with previous jobs that include chief operating officer of the $200 million Flex Capital VC fund.

Now at the civilian helm of the Army, Driscoll has been making his rounds on Capitol Hill and in the media calling for changes to how the service does business, in part by embracing smaller, VC-backed startups. (Driscoll’s potential deputy awaiting confirmation, Michael Obadal, is currently a senior director at Anduril.)

On the podcast, Driscoll said he believes the large prime contractors are slowly waking up to the fact that the Trump administration is ready to shake up the sector, and they can’t simply weather the storm or mobilize lobbyists to head to Capitol Hill.

“Their misunderstanding about this moment in time is, President [Donald] Trump’s and Secretary [Pete] Hegseth’s tolerance for pain to do the right thing on behalf of the American soldier, I truly believe it’s different and unique,” Driscoll said. “My best guess is that they will start to realize in the coming days, weeks and months, that they are going to have to adapt and change or die. We are not going to come to bail them out again as a nation.

“We want them to succeed,” he added. “Those remaining ones that can sell to the Army in a couple of years, they’re going to be incredible, because we won’t buy it unless they are.”

While his comments are new, Driscoll and Army Chief of Staff Gen. Randy George are making moves and executing on a new vision for the ground service. That includes a number of high-profile program cancellations like the Joint Light Tactical Vehicle and General Dynamics Land Systems’s new light tank, the M10 Booker, along with development of General Electric Improved Turbine Engine Program (ITEP) and a Future Tactical Uncrewed Aircraft System (FTUAS). Plans to ink a deal with Textron for a new fleet of Robotic Combat Vehicles (RCVs) are also on ice due to what Driscoll deemed a mismatch of requirements and spending priorities.

“We created this RCV. … It’s awesome,” Driscoll said on the podcast. “But is it worth $3 million per copy and an $800 drone can take it out? … The math doesn’t work.”

Driscoll isn’t alone in his quest to revamp the defense sector. Other Trump administration officials and GOP lawmakers have also suggested that new, smaller tech companies could be better positioned to respond to changes in threats — especially in key areas like artificial intelligence and software development — than the often slow-moving megaprimes.

In his confirmation hearing in February, for example, Deputy Defense Secretary Steve Feinberg, previously the co-founder of Cerberus Capital Management, told lawmakers that the current acquisition system favors legacy defense contractors by incorporating “gold-plated” technical requirements and rigid regulations that hold commercial companies and nontraditional vendors back.

Navy Secretary John Phelan, a former financier, has criticized the “lack of urgency” in naval shipbuilding and pledged to bring greater speed to the Navy’s acquisition plans.