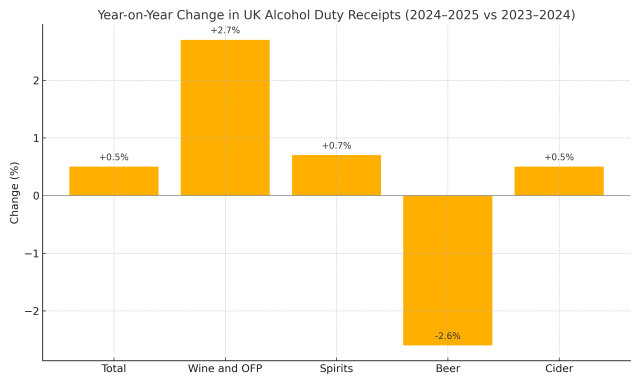

New HMRC data show UK alcohol duty receipts grew by just £57 million in 2024–2025, despite the introduction of a reformed tax structure in February and several increases prior. Beer receipts slumped 3% year-on-year while wine edged up 3% and spirits held largely steady.

Despite the fanfare surrounding the UK Government’s long-anticipated alcohol duty reform,

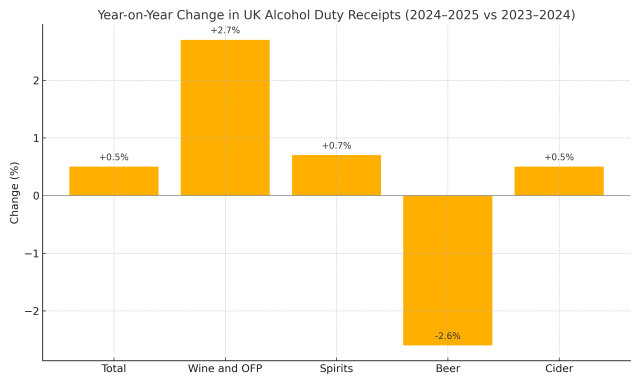

the latest bulletin from HMRC shows that receipts rose by just 0.5% in the 2024–2025 financial year, barely registering a fiscal impact from successive duty overhauls.

Between April 2024 and March 2025, total alcohol duty receipts reached £12.646 billion, up only £57 million on the previous year’s £12.589 billion. In a market reshaped by February’s uprating and the ongoing application of a per-litre-of-alcohol model, the data suggests the new regime has had limited short-term success in boosting Treasury income.

Wine leads, beer lags

Wine and other fermented products proved the most significant contributor, generating £4.735 billion in receipts, up 3% year-on-year. This category accounted for 37% of total alcohol duty revenues. Spirits brought in £4.164 billion, 1% more than the previous year and representing 33% of the duty total.

Beer receipts fell by £94 million to £3.527 billion, down 3%, while cider remained a small contributor at £221 million, just 2% of the total, with a slight 1% rise.

April shows concerning signs for 2025–2026

The first month of the 2025–2026 financial year may offer an early warning signal. Provisional April 2025 receipts fell to £921 million, down 7% (£69 million) on April 2024, when the total stood at £990 million. This fall-off is evident across categories, including a 9% year-on-year drop in wine receipts to £347 million and a 13% drop in spirits to £269 million.

While February saw a spike in receipts, £1.097 billion, compared to £773 million in February 2024, this is attributed to forestalling, with businesses likely accelerating clearances to avoid the

February 1 duty increase. March’s total then fell back to £802 million.

Duty distribution underlines structural shift

The 2024–2025 full-year breakdown shows wine and spirits remain the fiscal mainstays of the alcohol category, jointly contributing 70% of total receipts. Beer accounted for 28%, while cider remained a minor player.

By month, the receipts data reflect volatile activity across the year. Notably, December 2024 delivered the single highest monthly return at £1.509 billion, while March 2025’s £802 million was among the lowest, outside of pandemic-era outliers. This seasonal pattern continues to align with pre-reform years.

Structural complexity, administrative burden

Since 1 August 2023, alcohol duty in the UK has been based on the alcohol content of drinks across all categories. February’s uprating applied the new framework in full for wine products, eliminating the easement period and introducing a wide range of marginal duty bands based on ABV.

HMRC says that the February 2025 spike in wine and spirits receipts may again have been due to traders front-loading stock ahead of the new rates, rather than any underlying increase in demand.

The new figures suggest that, while the Government’s policy shift has succeeded in rebalancing the tax structure towards strength-based charging, the anticipated uplift in public revenue has yet to materialise.

For now, the data shows a system in transition, one that is more complex, administratively burdensome and yet not demonstrably more lucrative.

Source: HMRC

Despite the fanfare surrounding the UK Government’s long-anticipated alcohol duty reform, the latest bulletin from HMRC shows that receipts rose by just 0.5% in the 2024–2025 financial year, barely registering a fiscal impact from successive duty overhauls.

Between April 2024 and March 2025, total alcohol duty receipts reached £12.646 billion, up only £57 million on the previous year’s £12.589 billion. In a market reshaped by February’s uprating and the ongoing application of a per-litre-of-alcohol model, the data suggests the new regime has had limited short-term success in boosting Treasury income.

Despite the fanfare surrounding the UK Government’s long-anticipated alcohol duty reform, the latest bulletin from HMRC shows that receipts rose by just 0.5% in the 2024–2025 financial year, barely registering a fiscal impact from successive duty overhauls.

Between April 2024 and March 2025, total alcohol duty receipts reached £12.646 billion, up only £57 million on the previous year’s £12.589 billion. In a market reshaped by February’s uprating and the ongoing application of a per-litre-of-alcohol model, the data suggests the new regime has had limited short-term success in boosting Treasury income.

Source: HMRC

Source: HMRC