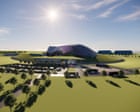

Delta Air Lines Eyes Potential New Hub in Orlando, Featuring 7 New Routes. Here Are the Details

Delta Air Lines is reportedly considering an Orlando hub.

Delta Air Lines is doubling down on the Sunshine State. Beginning Dec. 20, 2025, the Atlanta-based carrier will launch seven new Saturday-only seasonal routes out of Orlando International Airport (MCO) that connect Florida’s tourism capital with Birmingham, Cincinnati, Columbus, Kansas City, Milwaukee, Omaha, and Raleigh-Durham. The flights will run through April 11, 2026, signaling that Orlando — already one of America’s busiest and fastest-growing airports — could be quietly ascending from mere destination to de facto hub in Delta Air Lines’ network strategy.

Orlando’s Rapid Growth Positions It for Hub Status

According to Aviation A2Z, Orlando International handled more than 58 million passengers in 2023, and the airport isn’t slowing down. A multi-billion-dollar capital program is expanding gates, lounges, and its new Terminal C, giving Delta Air Lines the infrastructure headroom to grow without the congestion and slot constraints that dog legacy hubs such as New York–JFK or Los Angeles. Add Orlando’s year-round leisure demand and a booming local population, and MCO suddenly looks less like a spoke and more like a springboard.

Why Saturday-Only Flights Make Strategic Sense

Launching a point-to-point service from a non-hub might sound counterintuitive for an airline so steeped in the hub-and-spoke model. Yet Delta Air Lines has picked Saturday — a traditionally soft day for corporate travel — to maximize aircraft utilization without disrupting weekday schedules. Quick turnarounds handled by regional partners allow the carrier to “sample” a market cheaply. If load factors climb, weekday service can follow; if not, Delta reassigns the aircraft elsewhere. This capital-light approach offers asymmetric upside with limited downside, making Orlando the perfect test kitchen.

The New Orlando Routes at a Glance

- Birmingham (BHM)

- Omaha (OMA)

- Raleigh-Durham (RDU)

- Cincinnati (CVG)

- Columbus (CMH)

- Kansas City (MCI)

- Milwaukee (MKE)

Each city has an established Delta frequent-flier base, limited nonstop competition to Orlando, and population centers large enough to support a weekly leisure flight — ideal ingredients for a low-risk experiment.

A Pattern of Creative Deployments

This is not Delta Air Lines’ first foray into non-hub experimentation. In 2018, the carrier stunned analysts by launching Indianapolis–Paris service, and it once connected Pittsburgh to Charles de Gaulle on a Boeing 757. Those long, thin routes disappeared during the pandemic, but they proved that Delta is willing to zig where others zag when the math works. More recently, the carrier announced three winter-only Saturday flights — New York-JFK to Vail, LaGuardia to Bozeman, and Salt Lake City to Fort Myers — reinforcing its habit of tapping niche demand pools with surgical precision.

The Orlando gambit extends that playbook: deploy capacity where competitors overlook it, gather datapoints for four months, then decide whether to pivot, expand, or walk away.

Implications for Delta’s Network — And Its Rivals

Should the seven routes perform, Delta Air Lines could upgrade Orlando from “focus city” to full hub. Over time, that would mean:

- Expanded frequency: Weekday and possibly year-round service, particularly to business-heavy markets such as Raleigh-Durham and Kansas City.

- International adds: With Terminal C equipped for customs and immigration, transatlantic or Latin American flights could follow.

- Competitive ripples: Southwest and Frontier dominate Orlando’s point-to-point landscape; an upshift by Delta would pressure low-cost rivals on key leisure corridors while nibbling at JetBlue’s Northeast feed.

For passengers, more nonstop options translate into shorter travel days and potentially lower fares as carriers battle for share.

Rebranding Fare Classes To Match Network Flexibility

A broader transformation is happening behind the scenes. On October 1, Delta Air Lines will retire the “Basic Economy” label and fold it into a new three-tier “Delta Main” category — Basic, Classic, and Extra — while Comfort+ becomes Delta Comfort, and First Class becomes Delta First. The rebrand is about “clarity and choice,” according to Chief Digital Officer Eric Phillips, but it also dovetails with the airline’s nimble route strategy. As Delta probes new markets like Orlando, a more granular fare architecture lets revenue managers fine-tune price points and capture maximum demand without confusing customers.

What Flyers Can Expect on the New Orlando Flights

Because the services are Saturday-only, travelers should think of them as “pop-up” routes crafted for weekend escapes — ski trips from Omaha, theme-park pilgrimages from Milwaukee, beach breaks for Cincinnati families. All flights will be available for cash or SkyMiles redemptions, though (as with Delta’s other seasonal launches) don’t expect low-mileage saver awards. Equipment will vary by route, but early filings suggest a mix of mainline Airbus A319s and Boeing 737-800s paired with regional jets on shorter legs like Birmingham.

A Measured Bet With Outsized Potential

Delta Air Lines’ Orlando expansion is equal parts prudence and ambition. By flying weekly rather than daily, the carrier limits operational risk. By targeting medium-sized metros underserved by nonstop service, it unlocks new revenue streams. And by staking an early claim at an airport, investing heavily in capacity, Delta positions itself ahead of future demand curves.

If the coming winter proves successful, expect to see more than seven routes and more than Saturday-only service out of MCO. Orlando may soon take its place alongside Atlanta, Minneapolis-St. Paul, Salt Lake City, and Detroit as a critical connective node in Delta Air Lines’ global network. For travelers and watchers of the industry alike, that possibility makes this seemingly modest launch one of the most intriguing airline stories heading into 2026.