Pulse on Pay: 12 Years of CEO Pay Long-term Trends in S&P 500 Executive Compensation

Equity Prevalence and Average Vehicle Mix for CEOs Key Takeaways: Long-term incentive (LTI) designs have become strongly aligned with institutional investor and proxy advisor preferences through increased performance stock and restricted stock units and reduced stock options. The increase in restricted stock is notable because it is the least intuitively linked to performance of the […]

Margaret Hylas is a Principal, and Leah Sine is an Associate at Semler Brossy. This post is based on their Semler Brossy memorandum.

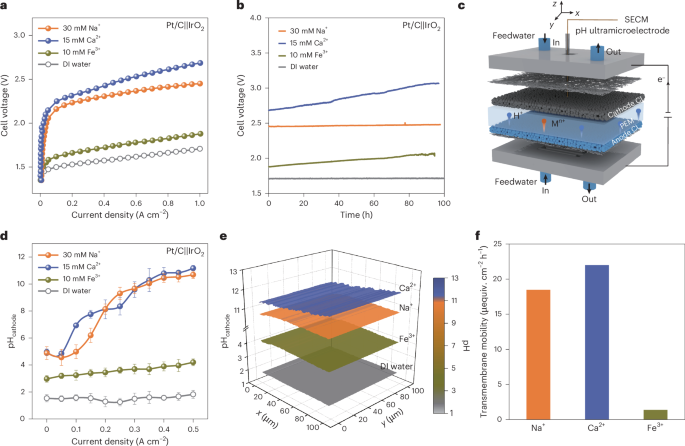

Equity Prevalence and Average Vehicle Mix for CEOs

Key Takeaways: Long-term incentive (LTI) designs have become strongly aligned with institutional investor and proxy advisor preferences through increased performance stock and restricted stock units and reduced stock options. The increase in restricted stock is notable because it is the least intuitively linked to performance of the three vehicles.

We believe the current state reflects the evolution of equity compensation strategies towards a balance of active performance management and risk mitigation.

95% of S&P 500 companies currently use PSUs, up from 76% in 2012 (PSUs represent an average of 60% of CEO LTI mix).

Only 42% of S&P 500 companies currently use options, down from 68% in 2012 (Options represent an average of 13% of CEO LTI mix) 77% of S&P 500 companies currently use RS Us, up from 58% in 2012. (more…)