GE pushes for faster fielding of Army’s ITEP, Air Force’s NGAP engines

GE executive Mark Rettig said the company’s recent foray into hypersonic technology has opened a new range of opportunities for the engine maker.

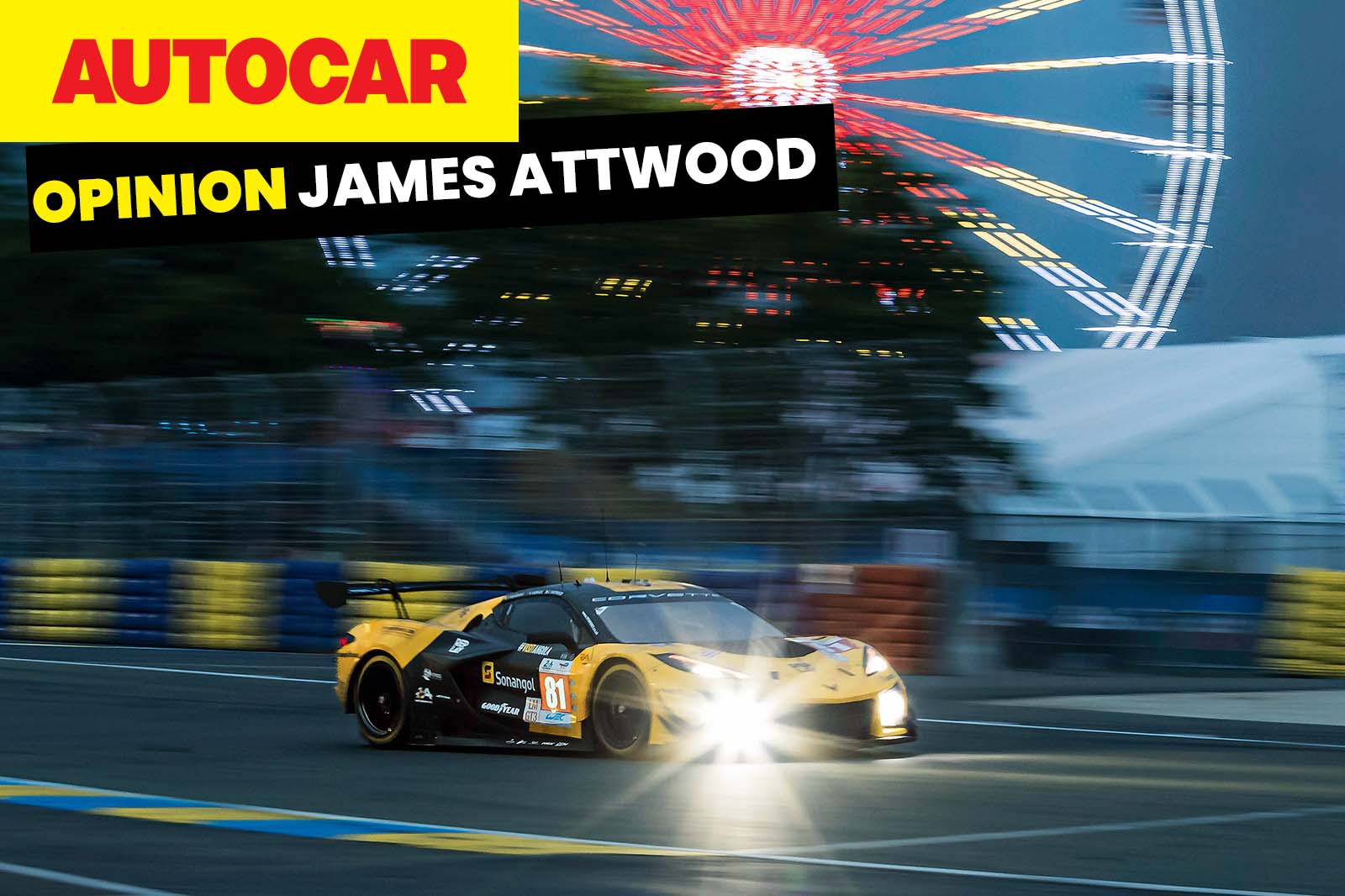

GE’s prototype of its T901 turbine, selected by the Army for its Improved Turbine Engine Program (ITEP)

EVENDALE, Ohio — GE is pushing to accelerate two key aircraft engine programs for the Pentagon, one in the hopes of salvaging a major Army effort and the other to more rapidly field a new type of jet engine that could power next-generation aircraft like the F-47 stealth fighter.

During a tour of GE’s headquarters here on June 1, company officials said that though the Army halted work on the T901 engine, also known as the Improved Turbine Engine Program (ITEP), they’re betting that a plan to field the powerplant faster could make it more attractive to the service amid disruptive changes led by Secretary Daniel Driscoll.

The T901 engine was planned to replace the legacy T700 that currently powers the Army’s UH-60 Black Hawks and AH-64 Apaches, with the intent of providing 50 percent better horsepower and 25 percent more fuel efficiency. GE’s T901 engine was selected for the program in 2019 but was struck by development delays. Service leaders stuck with the program throughout its troubles, but ultimately opted to eliminate funding for the it in fiscal year 2026 as part of the larger Army Transformation Initiative shakeup.

GE Defense & Systems CEO Amy Gowder, who spoke before the administration’s budget was revealed, acknowledged that ITEP’s fate would be determined by how the FY26 budget plays out. Nevertheless, she emphasized that lawmakers have supported the program in the past and still have their say in the budget process. (The House appropriations committee earmarked $175 million for ITEP in its version of the FY26 budget.)

Were ITEP to continue, Gowder acknowledged it would be moving at a faster pace. “The Army is very, at the senior level, from the secretary and on, they’re very open to challenging the testing requirements,” she said. For example, Gowder said, designs could be tested for performance and operational capability, but testing that takes a design to its limits could be saved for later. And, she stressed, the engine could still be applicable to other platforms and exported abroad, with Gowder raising the possibility of a next-gen helo in Europe.

“The positive thing about the Army Transformation Initiative is they are very open minded, whereas maybe in the past, some of the leadership was more conservative,” she said. (Like other media, Breaking Defense accepted accommodations from GE for the visit.)

Gowder similarly said GE engineers were prepared to quicken the pace for another high-profile effort, the Air Force’s Next Generation Adaptive Propulsion (NGAP) program, where GE and Pratt & Whitney are separately designing a new powerplant with an “adaptive” engine architecture that would unlock greater fuel efficiency and thrust. The NGAP program was envisioned to provide an engine for the Next Generation Air Dominance fighter now known as the F-47, and could go on to serve other propulsion needs for future aircraft.

To field the NGAP engine faster, Gowder said GE is pitching the Air Force on a plan to skip the technology maturation and risk reduction (TMRR) phase, saving about three to four years of time for the program. The plan would work by GE going straight from ongoing prototyping, which budget documents published last year show is slated to continue through FY27, into a phase known as engineering and manufacturing development, skipping over TMRR in the process.

Gowder said lessons gleaned from and similarities to the NGAP’s predecessor, the Adaptive Engine Transition Program, means GE’s NGAP design, dubbed the XA102, is more mature than a typical prototype. Specifically, Gowder said 96 percent of all the XA102’s “components and pieces” are “product relevant and not prototype.”

It’s still not clear how quickly the NGAP engine could be flight-ready under GE’s hastened proposed schedule — Gowder said officials were not at liberty to say —including whether the engines could be ready in time to power the F-47 that is planned to fly before the end of President Donald Trump’s term. (An Air Force official said the NGAP engine’s “architecture is platform agnostic, and designs can be tailored to an extent for future fighter and other aircraft operating across various mission threads.” However, they declined to comment on the program’s timeline for fielding the new powerplant.)

It’s also not clear how the NGAP program may ultimately shake out. The Air Force is proposing to trim the program’s funding down to $330 million in FY26, Breaking Defense previously reported. Meanwhile, congressional committees are finalizing their budget proposals, and as part of the House appropriations’ legislation detailed in documents previously reported by Politico, the committee would fund the NGAP program with $440 million.

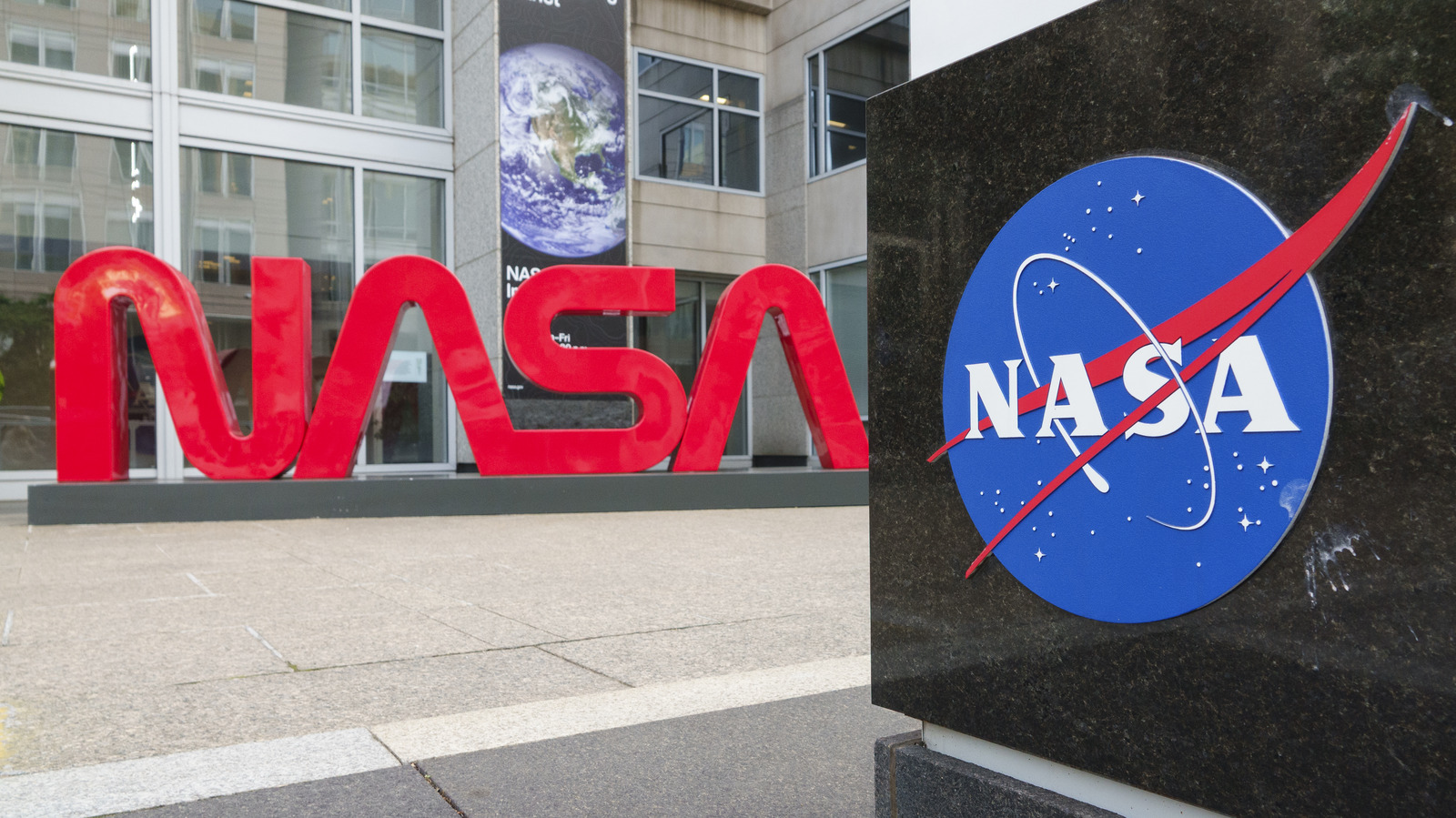

GE Aerospace’s hypersonic dual-mode ramjet. (GE image)

Hypersonic Ambitions

Heeding a demand signal for systems that can quickly hit distant targets, GE officials said they are branching out into high speed, hypersonic flight through new ramjet expertise gained from the company’s acquisition in 2022 of the startup firm Innoveering.

For example, GE Edison Works Vice President and General Manager of Advanced Programs Mark Rettig said a liquid ramjet engine in testing by GE could be offered for the Air Force’s Standoff Attack Weapon, a long-range missile revealed by the service in 2022 but that has received little attention since.

A separate dual mode ramjet engine, Rettig said, could also be useful for a “variety of opportunities,” including for the fifth increment of the Army’s Precision Strike Missile that officials want to be able to hit targets beyond 1,000 km. (The current baseline PrSM missile is supplied by Lockheed Martin and powered by a rocket booster produced by Northrop Grumman.)

For now, Rettig said a key focus is scaling up a dual mode ramjet enhanced with rotating detonation combustion technology. The company is also expanding its hypersonic testing capacity as plans mature.

GE previously tested a dual mode ramjet in a configuration Rettig called “product relevant” — roughly 3,000 pounds of thrust, or sufficient to support a “significantly larger weapons size.” That configuration will now be tested with the rotating detonation combustion feature this month, which will help determine whether the combination can reliably operate and eventually be scaled up.

The technology, GE thinks, could also be applied to reusable hypersonic aircraft like one currently sought by the Air Force and DARPA. By pairing a high-Mach turbofan engine with the rotating combustion-enabled dual-mode ramjet, GE hopes to offer an integrated, end-to-end propulsion solution that solves the problems typically associated with transitioning between a turbofan and a ramjet.

“A lot of what we’ve been working on internally is to try to really bring that mode transition speed down and allow a much more robust transition,” said Craig Young, GE’s executive engineering director for hypersonic propulsion and small UAV engines. “And by integrating the propulsion systems, our concepts give you zero to Mach six-plus propulsion, all through one throttle is the ideal.”