Cass Freight Index: Shipments down, rates up in May

May data from Cass Information Systems shows continued pressure on freight demand, but carriers are experiencing some pricing relief. The post Cass Freight Index: Shipments down, rates up in May appeared first on FreightWaves.

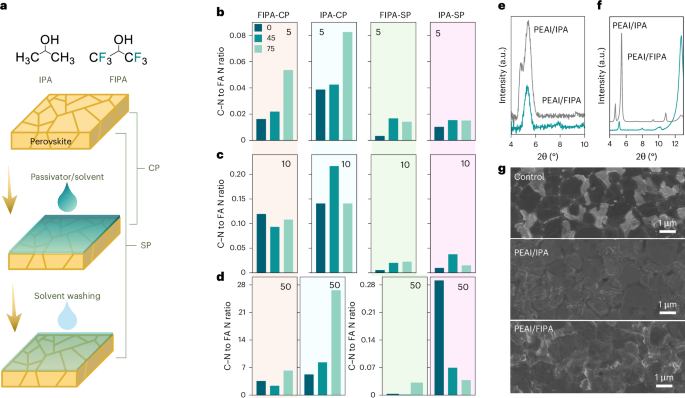

According to monthly data from Cass Information Systems, freight shipments declined again in May and underperformed normal seasonal trends. However, carriers successfully advanced pricing initiatives as trade tensions appear to be easing.

Cass’ multimodal shipments index dipped 0.4% from April to May (down 3.4% seasonally adjusted) and was 4% lower than the same month last year. The dataset has been underwater on a year-over-year comparison for 28 straight months.

“The trade war is having a variety of effects, with pre-tariff consumer spending still supporting freight demand,” the report said. “The negative consequences of tariff effects are partly reflected in May data, as pre-tariff inventory stocking has started to turn to destocking, and those stocks will start to thin in the coming months.”

May 2025

y/y

2-year

m/m

m/m (SA)Shipments -4.0% -9.6% -0.4% -3.4% Expenditures 0.8% -8.3% 1.4% 1.2% TL Linehaul Index 0.6% -1.2% -0.8% NM

This update aligns with commentary from intermodal carrier management teams appearing at an investor conference this week. They noted that, while the freight market hasn’t fully returned to normal seasonality, the fallout from tariff-related order volatility has been exaggerated and that the worst-case trade scenarios contemplated earlier in the year now appear unlikely.

June shipments are projected to be down 2% y/y if normal seasonal trends hold through the rest of the month, the report said.

Cass’ freight expenditures dataset, which measures total freight spend including fuel, increased 1.4% sequentially (1.2% higher seasonally adjusted) and 0.8% y/y. (Diesel prices were down 8% y/y and 2% sequentially in May.)

This was the second consecutive y/y increase in the expenditures dataset after 26 months of decline.

Netting the change in shipments from the change in expenditures shows actual freight rates were approximately 5% higher sequentially (seasonally adjusted) and y/y. The freight mix captured by the index is currently moving toward truckload from less-than-truckload.

The inferred rate dataset was down 7% y/y last year.

Cass’ TL linehaul index, which tracks rates excluding fuel and accessorial surcharges, increased 0.6% y/y (down 0.8% sequentially). This was the fifth consecutive y/y increase in TL linehaul rates.

“The effects of tariffs have yet to be fully felt, and although freight rates have started to rise, it is still not enough to offset cost headwinds broadly,” the report said.

“The trade war is likely to extend the for-hire freight recession further as higher prices reduce goods affordability and consumers’ real incomes. With the demand outlook choppy, the rate upturn remains elusive, but the equipment cycle is setting up tighter capacity with Class 8 tractor sales falling below replacement this year.”

Data used in the indexes comes from freight bills paid by Cass (NASDAQ: CASS), a provider of payment management solutions. Cass processes $36 billion in freight payables annually on behalf of customers.

More FreightWaves articles by Todd Maiden:

- Forward Air chairman, 2 directors leave after shareholder vote

- Intermodal carriers getting ‘a bit more optimistic’

- Dynamic pricing, easy comps end 22-month tonnage downturn at ArcBest

The post Cass Freight Index: Shipments down, rates up in May appeared first on FreightWaves.