Deliveroo strikes £2.9bn takeover deal with US rival DoorDash

Deliveroo has agreed to a £2.9bn takeover by US rival DoorDash.

Deliveroo has agreed to a £2.9bn takeover by US rival DoorDash.

The delivery platform received an offer worth 180p-a-share at the start of last month and on Tuesday, it recommended the deal to shareholders.

The takeover offer is aimed at expanding the DoorDash brand into Europe for the first time and strengthening Deliveroo’s market share amid increasing competition from UberEats and JustEat.

The combined group will have a presence across 40 countries, with annual orders worth around £10bn.

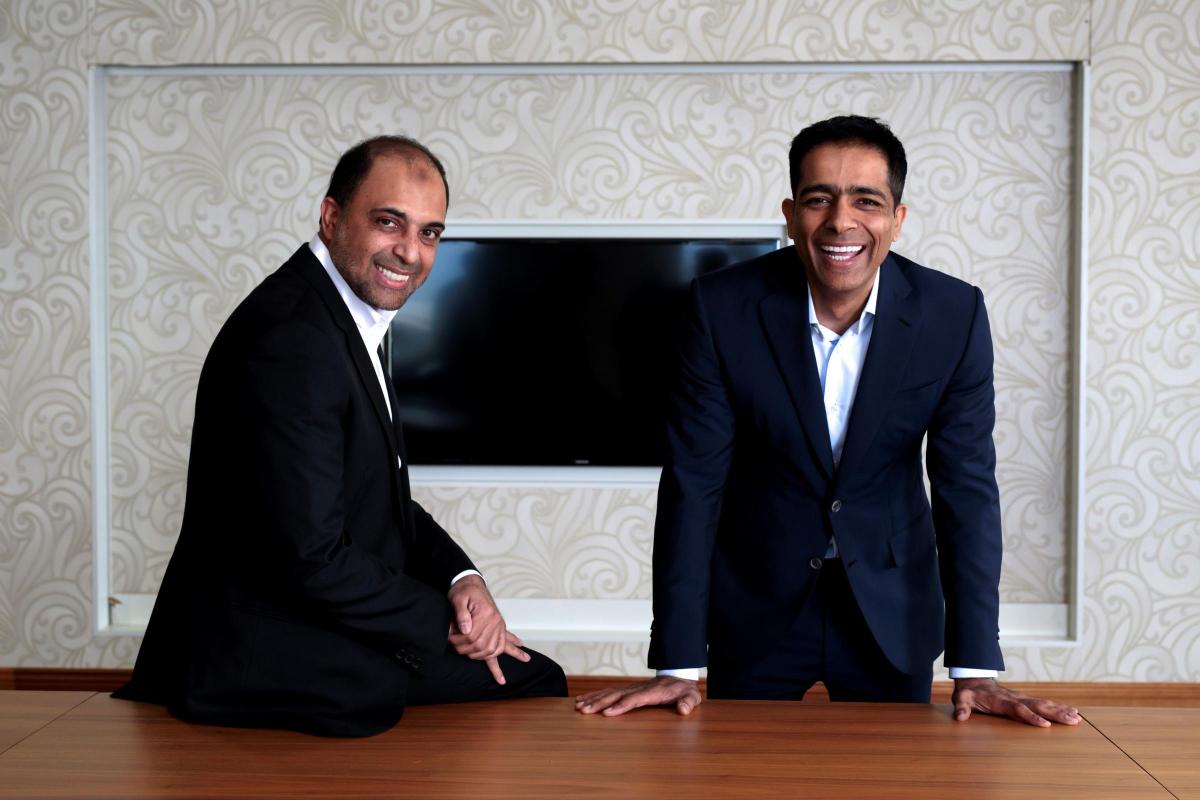

Deliveroo’s co-founder and chief executive Will Shu is in line to receive more than £170m from his 6.4% shareholding when the sale is expected to complete later this year.

Shu said: “We are now at the beginning of a transformative new chapter. DoorDash and Deliveroo are like-minded organisations with a shared strategic vision and aligned values.

“Together, we will be even better positioned to serve consumers, merchants, riders and local communities. The Enlarged Group will have the scale to invest in product, technology and the overall consumer value proposition.”

Tony Xu, CEO and Co-founder of DoorDash, added: “The Enlarged Group will bring together DoorDash’s strong operating playbook with Deliveroo’s local expertise to invest in innovation and execution at an even higher level.”

Deliveroo launched its grocery service in 2020, partnering with the likes of Sainsbury’s, Waitrose, Morrisons and Co-op. It has since teamed up with specialist retailers including Boots, B&Q, Wilko and The Perfume Shop to offer a rapid delivery service.

The retail partnerships helped the platform swing to its first annual profit last year, up from a £32m loss in 2023.

Deliveroo posted a profit of £3m in the year to 31 December 2024, as grocery hit 16% of the business’s group transaction value (GTV) during the second half.

Click here to sign up to Retail Gazette‘s free daily email newsletter