Anticipation in Russia Regarding ‘Informal Negotiations’ for Inditex’s Return

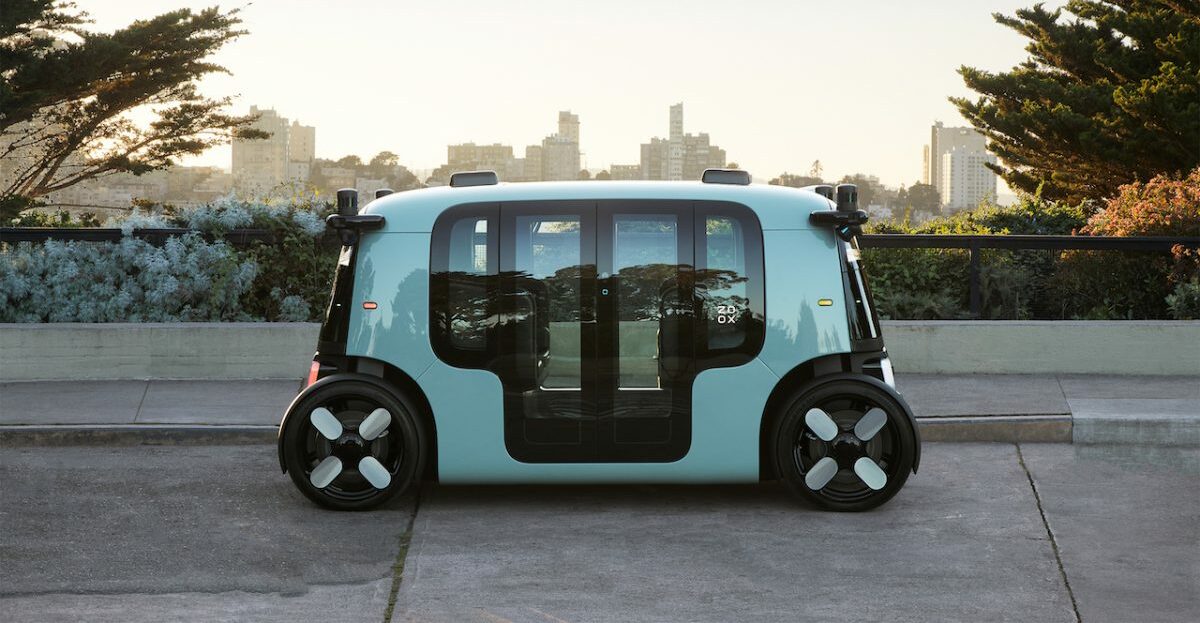

Zara store in the Westfield Old Orchard shopping centre in Skokie, Illinois (United States). Credits: Zara. Madrid – Is Inditex preparing to return to Russia? That is precisely what the Parlamentskaya Gazeta, the official media outlet of the Russian Parliament, suggested. It openly pointed to the “informal negotiations” that the Spanish fashion multinational is supposedly holding for the potential, and soon, return of its brands to the Russian market. Published at the end of April, the piece by the Russian state media outlet emerged as a response to the anticipation in the country regarding Ikea’s potential return. This followed news that the Swedish furniture and homeware multinational had submitted the necessary documentation to register its trademark for 18 categories of products and services. The registration is valid until 2033. Several analysts and retail sector professionals in Russia saw this as a sign of the Swedish multinational’s “imminent return” to the Russian market. Pavel Luilin, vice president of the Union of Shopping Centres of Russia, Belarus, Kazakhstan (SCA), corrected this analysis in the Parlamentskaya Gazeta. He revealed the advanced “informal negotiations” that both Spanish company Inditex and Japanese company Uniqlo had supposedly undertaken to resume operations in the Russian market. Luilin pointed out that, regarding Ikea, the vice president of the SCA noted that the Swedish company had only registered its trademark to protect its name. This was to prevent the Ikea name from being used to launch a competing local chain under the same brand, filling the void left by the Swedish multinational after its decision to cease operations in the country in March 2022. They remained firm on this decision. From then until November 2024, the Swedish multinational carried out a determined divestment process, leading to the sale of all its assets in the Russian Federation. These assets included four factories, 14 shopping centres, and a large logistics warehouse, which the Swedish company eventually sold to Russian groups and business owners. This process did not fully align with any of the three scenarios established by the Kremlin for foreign brands operating in the country before the Russian army’s invasion of Ukraine. These scenarios were: to remain, to transfer their businesses, or to liquidate their operations and dismiss their workers. Luilin warned of the risk this poses for Ikea, following the Ericsson case. The Swedish telecommunications company became the first to undergo a forced brand expropriation process, setting a dangerous precedent that Ikea is supposedly trying to avoid with this new trademark registration. However, Russian authorities could block this attempt. It is difficult to assess whether Luilin’s words to the Parlamentskaya Gazeta, stating that one cannot speak of Ikea’s return because the shopping centres it occupied are already taken and there is no commercial space in the country today to support its commercial format, are a reflection of reality or a warning to demonstrate greater commitment to its potential return to the country, lest it follow Ericsson’s example and be deprived of its brand rights. The vice president of the SCA presented the situation of international fashion brands as a radically opposite case to Ikea’s more improbable (or slower) return to Russia, speaking to the official Russian media outlet. Some firms have continued to operate in the country, such as Spanish company Mango. Others have already begun to make moves towards their upcoming return to Russia. Luilin told the Parlamentskaya Gazeta that Japanese chain Uniqlo, owned by Fast Retailing, and Spanish company Inditex, parent company of popular fashion chains such as Zara, Massimo Dutti, Bershka, Oysho, and Pull&Bear, are gaining an advantage and maintaining more advanced negotiations. The vice president of the SCA indicated that both companies are currently in the initial stage of “informal negotiations” to agree on their swift return to Russia. He suggested that fashion firms that left the country after the invasion of Ukraine would need about a year before returning to activity in Russia. This timeframe could potentially be shorter for Inditex. Maximum Anticipation for Return of Inditex Brands Despite the vice president of the SCA highlighting in his statements to the Parlamentskaya Gazeta that Western brands and companies that ceased operations in Russia after the war in Ukraine, including Inditex, would need a “trigger” to smooth their return, likely the lifting, even if only partial, of international sanctions imposed on cross-border payments, the mention of “informal negotiations” and that the process would be “faster” for Inditex’s brands has caused maximum anticipation throughout Russia for what has been announced as the return of Zara, Bershka, Pull&Bear, and other group firms. Following the publication of the news in the state media outlet, Pavel Luilin himself publicly “co

Madrid – Is Inditex preparing to return to Russia? That is precisely what the Parlamentskaya Gazeta, the official media outlet of the Russian Parliament, suggested. It openly pointed to the “informal negotiations” that the Spanish fashion multinational is supposedly holding for the potential, and soon, return of its brands to the Russian market.

Published at the end of April, the piece by the Russian state media outlet emerged as a response to the anticipation in the country regarding Ikea’s potential return. This followed news that the Swedish furniture and homeware multinational had submitted the necessary documentation to register its trademark for 18 categories of products and services. The registration is valid until 2033. Several analysts and retail sector professionals in Russia saw this as a sign of the Swedish multinational’s “imminent return” to the Russian market. Pavel Luilin, vice president of the Union of Shopping Centres of Russia, Belarus, Kazakhstan (SCA), corrected this analysis in the Parlamentskaya Gazeta. He revealed the advanced “informal negotiations” that both Spanish company Inditex and Japanese company Uniqlo had supposedly undertaken to resume operations in the Russian market.

Luilin pointed out that, regarding Ikea, the vice president of the SCA noted that the Swedish company had only registered its trademark to protect its name. This was to prevent the Ikea name from being used to launch a competing local chain under the same brand, filling the void left by the Swedish multinational after its decision to cease operations in the country in March 2022. They remained firm on this decision. From then until November 2024, the Swedish multinational carried out a determined divestment process, leading to the sale of all its assets in the Russian Federation. These assets included four factories, 14 shopping centres, and a large logistics warehouse, which the Swedish company eventually sold to Russian groups and business owners. This process did not fully align with any of the three scenarios established by the Kremlin for foreign brands operating in the country before the Russian army’s invasion of Ukraine. These scenarios were: to remain, to transfer their businesses, or to liquidate their operations and dismiss their workers. Luilin warned of the risk this poses for Ikea, following the Ericsson case. The Swedish telecommunications company became the first to undergo a forced brand expropriation process, setting a dangerous precedent that Ikea is supposedly trying to avoid with this new trademark registration. However, Russian authorities could block this attempt. It is difficult to assess whether Luilin’s words to the Parlamentskaya Gazeta, stating that one cannot speak of Ikea’s return because the shopping centres it occupied are already taken and there is no commercial space in the country today to support its commercial format, are a reflection of reality or a warning to demonstrate greater commitment to its potential return to the country, lest it follow Ericsson’s example and be deprived of its brand rights.

The vice president of the SCA presented the situation of international fashion brands as a radically opposite case to Ikea’s more improbable (or slower) return to Russia, speaking to the official Russian media outlet. Some firms have continued to operate in the country, such as Spanish company Mango. Others have already begun to make moves towards their upcoming return to Russia. Luilin told the Parlamentskaya Gazeta that Japanese chain Uniqlo, owned by Fast Retailing, and Spanish company Inditex, parent company of popular fashion chains such as Zara, Massimo Dutti, Bershka, Oysho, and Pull&Bear, are gaining an advantage and maintaining more advanced negotiations. The vice president of the SCA indicated that both companies are currently in the initial stage of “informal negotiations” to agree on their swift return to Russia. He suggested that fashion firms that left the country after the invasion of Ukraine would need about a year before returning to activity in Russia. This timeframe could potentially be shorter for Inditex.

Maximum Anticipation for Return of Inditex Brands

Despite the vice president of the SCA highlighting in his statements to the Parlamentskaya Gazeta that Western brands and companies that ceased operations in Russia after the war in Ukraine, including Inditex, would need a “trigger” to smooth their return, likely the lifting, even if only partial, of international sanctions imposed on cross-border payments, the mention of “informal negotiations” and that the process would be “faster” for Inditex’s brands has caused maximum anticipation throughout Russia for what has been announced as the return of Zara, Bershka, Pull&Bear, and other group firms. Following the publication of the news in the state media outlet, Pavel Luilin himself publicly “cooled down” the expectations generated by a wave of “clickbait”. He reiterated, now from his social media, that the return of international fashion brands would require a period of about a year from the lifting of sanctions. This period could be shorter for those more prepared, such as Inditex, but not excessively so.

“Let’s cool down a bit the great massive wave of ‘clickbait’ news about the supposed return of Zara, Bershka, Pull&Bear, and Uniqlo this year,” said the vice president of the SCA, criticising the “very bold” headlines that had been generated in Russia, and outside Russia, from his statements and the information published by the Parlamentskaya Gazeta. He made this point to then highlight how, firstly, for the return of international brands, such as Zara or Uniqlo, the necessary conditions must be in place, both in Russia and in their countries of origin, to facilitate that return. These conditions do not currently exist and would begin with the lifting of the first sanctions. Secondly, Luilin reiterated that it will take approximately one year before companies can readjust their operations in terms of production, purchases, and the opening of offices and stores, before returning to activity in Russia. In some cases, such as Inditex, this process would be “a little shorter, but not much” more.

After reiterating these two main points, the vice president of the SCA placed special emphasis on highlighting cases such as Ikea or the Finnish hypermarket chain Prisma. Due to the particularities of their large-format retail model, they must embark on complicated construction projects, making it more difficult, if not slower, to discuss their potential return to Russia. He concluded his warnings for the potential return of international firms to the Russian Federation by pointing out a significant issue: the growing Russian retail industry has filled the void left by international firms after their abrupt departure in 2022. These retail companies now view the potential return of major international brands with scepticism and reluctance. The Kremlin has already warned of its position to guarantee conditions that are especially favourable for Russia and for Russian companies and companies from “allied countries”, which have become a priority for operating in the Russian market.

Potential Return Under Franchise Agreement

Inditex has neither confirmed nor denied the possibility of these “informal negotiations” for the potential return of its fashion brands to Russia. It has limited itself to stating that there are no updates regarding the company’s position in the country since Inditex agreed in October 2022 to sell its business in Russia to the Emirati group Daher, based in Dubai. This company is owned by the same Lebanese family, Daher, which, through its company Azadea Group, had already been serving as Inditex’s franchise partner for its operations throughout the Middle East and Africa.

According to the Spanish company, after announcing on March 5, 2022, the decision to “temporarily” suspend the activity of the 502 stores that Inditex operated in Russia at the time, a market that represented 8.5 percent of the group’s earnings before interest and taxes (EBIT), and which at the close of the 2020 financial year was its second-largest market, both in terms of commercial footprint and business volume, behind only Spain, the Spanish multinational had agreed to sell its business in the Russian Federation to the Daher Group. They argued that this decision would allow them to maintain a “substantial part” of the jobs, as it contemplated the transfer of most of the stores previously occupied by the Spanish group’s brands. These establishments would then operate under the umbrella of Daher Group’s own brands, “completely unrelated to Inditex”, the owner of Zara emphasised.

Having clarified that point, Inditex also outlined its potential return to the Russian Federation in that statement, sent to the Comisión Nacional del Mercado de Valores (CNMV) on October 25, 2022. They indicated that, to reach that scenario, the appropriate circumstances must first exist that, in Inditex’s view, “would allow the return of the group’s brands” to Russian territory. If so, the company had already established a principle of collaboration agreement with Daher, under which the Emirati company would have the possibility of becoming Inditex’s franchise partner, and of its portfolio brands, within the Russian Federation. This agreement would precisely facilitate Inditex in speeding up those times of about a year that Pavel Luilin mentioned, and which, in his opinion, international firms will need before being able to return to activity in Russia.

FashionUnited uses AI language tools to speed up translating (news) articles and proofread the translations to improve the end result. This saves our human journalists time they can spend doing research and writing original articles. Articles translated with the help of AI are checked and edited by a human desk editor prior to going online. If you have questions or comments about this process email us at info@fashionunited.com

This article was translated to English using an AI tool.